Security Token Offerings – How Do they Work + Examples

Tech Report is one of the oldest hardware, news, and tech review sites on the internet. We write helpful technology guides, unbiased product reviews, and report on the latest tech and crypto news. We maintain editorial independence and consider content quality and factual accuracy to be non-negotiable.

Security token offerings (STOs) advance traditional investment opportunities through safeguarded and transparent asset ownership using blockchain.

Imagine owning a fraction of a real estate property worth millions without needing to invest six figures in the whole asset or owning a shielded ‘IOU.’ STOs make this possible through legal frameworks and smart contracts that fractionalize digital assets for part ownership.

STOs are regulated for fundraising compared to initial coin offerings (ICOs), which are also used for raising capital but are more loosely governed.

According to Fortune Business Insights, the tokenization market worldwide was valued at $2.81B last year, and it’s predicted to reach $3.32B in 2024 and $13.20B by 2032 – a CAGR of 18.8%.

In our research, we explore all things STOs: what they are, how they function, and their pros and cons.

-

-

What is a Security Token Offering?

STOs represent investment ownership clearly and transparently through blockchain technology.

Through security token offering services, entities like businesses and governments can issue STOs that serve the same purpose as bonds, stocks, and other equities.

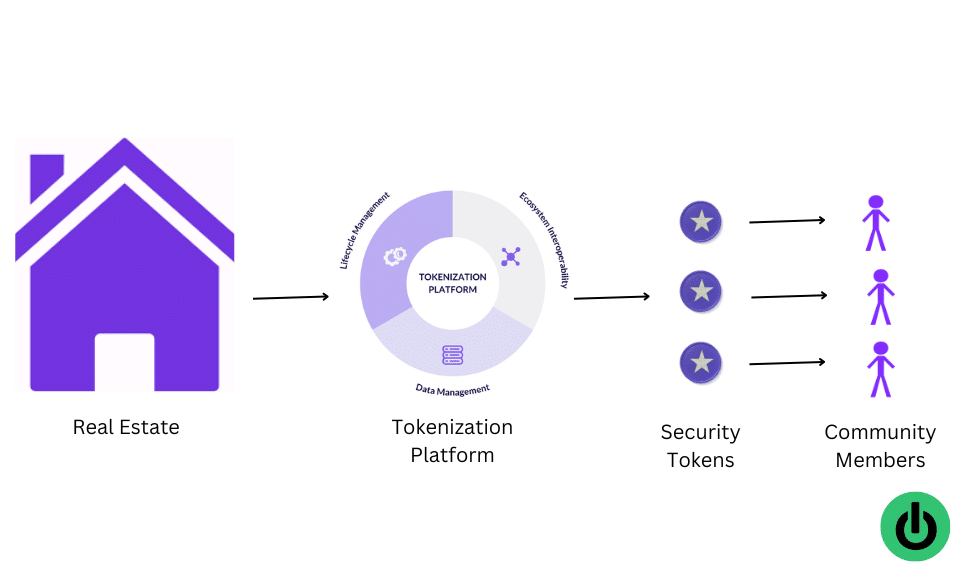

Knowledge surrounding tokenization is essential in understanding the concept of STOs. Tokenization consists of converting real-world rights or assets into digital tokens, which can then be transferred or traded onto a blockchain network.

Almost anything has the potential to be tokenized. For instance, real estate can be fractionalized into tokens to enable numerous buyers to own a stake in the property.

Consequently, these security tokens legally signify ownership and can be traded just like any other asset.

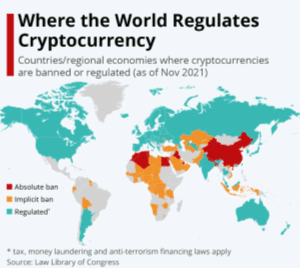

However, STOs are only recognized in certain jurisdictions, with the US, Germany, and Switzerland at the forefront.

The US is a prime choice for most STO offerings because of its stringent regulatory standards in relation to the issuance of securities, including:

- SEC registration before issuing STOs

- Only being able to sell STOs to accredited investors with a yearly salary of $200K for two years and $1M net worth

- Transactions must be conducted through a licensed broker-dealer

Moreover, instead of companies issuing paper stock certificates to investors to represent rights and ownership, each STO’s ownership is recorded on a public blockchain ledger, which presents the owner’s blockchain address to ensure security and transparency.

Regulators oversee STOs to ensure they meet the specific criteria of the Howey test, which assesses whether or not a financial investment, expectation of profit, and joint enterprises are present in an investment.

There are three types of STOs that prove beneficial across industries: equity tokens, debt tokens, and asset-backed tokens.

Equity tokensDebt tokensAsset-backed tokensEquity tokens offer a clearer and more secure form of asset ownership and trading, enhancing regulation and transparency compared to traditional models.

Paper certificates are increasingly becoming unnecessary. Many modern platforms – some of which don’t provide actual ownership of securities – do not require paper certificates. eToro, for example, issues IOUs instead.

Diversified regulations and confirmations make ownership verification complicated and challenging to understand, which typically leads to market inefficiencies.

The US derivatives market, in particular, is under regulated, which can cause issues like over-issuance of IOUs and Contracts for Differences (CFDs).

However, with equity tokens, ownership is recorded on an immutable ledger, updated and maintained by a decentralized network, ensuring that ownership records are detectable and immutable across all parties, removing FTD risks and instilling security and trust.

Additionally, the blockchain’s qualities enable real-time trade settlements, minimizing the waiting period (which can take weeks and even months) to minutes and sometimes seconds. Thus they streamline the entire settlement process.

Holders of equity tokens can gain a share of a company’s profits and may be granted voting rights. They offer several benefits to a business’s financial strategy, decision-making, and regulatory compliance.

- Investors gain governance rights of a company while adhering to compliance regulations

- Transparency in ownership and trading because of showing investors’ records and transaction histories

- Startups obtain access to novel and innovative fundraising strategies

- Regulators profit from a modern, clear framework for analyzing capital-raising activities

Debt tokens are short-term loans involving interest rates for investors that can provide a company with capital.

These tokens have the functionality to link to numerous types of debt, spanning from corporate bonds to mortgages.

The cost of the debt token is influenced by many factors, such as the nature of the debt (like a bond from a pre-listed company or a mortgage) and the company itself because some are healthier and more profitable than others.

On the blockchain, debt tokens are overseen by smart contracts that showcase debt information like repayment terms and risk profiles.

- Debt tokens provide flexibility in accessing different debt obligations through blockchain tech

- Investors can modify their level of risk exposure and potential returns by selecting different types of debt tokens

- Smart contracts strengthen efficiency and transparency in managing debts through decentralized networks

Asset-backed tokens feature ownership of real-world assets like art, commodities, real estate, revenue streams, and more.

Leveraging blockchain’s immutability, security, and transparency ensures a trustworthy transaction record and reduces risks like fraud.

Each of these tokens could digitally replicate commodities like gold (as similarly demonstrated by Tether) and oil, adding real-world value to trades.

Such STOs are often held by trusted custodians like specialized storage facilities or regulated financial entities. However, regulatory changes, mismanagement and security breaches can pose risks, affecting the associated tokens liquidity and real-world value.

- Asset-backed tokens broaden access to real-world assets like art and real estate through fractional ownership, international availability, and increased liquidity

- Blockchain technology boosts trust and transparency in commodity trading because it records all transactions in real time and abides by regulatory compliance

- Each of these tokens offers effective and streamlined settlement processes, potentially enhancing how assets are purchased and sold worldwide

What is an STO and How Does It Work?

Current investment methods are renowned for involving barriers to entry like limited accessibility, and requiring complex paperwork. For example, foreign investors struggle investing in Indian government bonds due to heavy paperwork being necessary.

STO in business offers a modernized approach when compared to conventional investment methods. Advantages include:

- Transparency: By STOs being recorded on blockchain networks (think a common ledger where everyone has to sign off on any modification), they can provide a clear and immutable record of transfers and ownerships that are tamper-proof, reducing the risk of manipulation and fraud

- Accessibility: By fractionalizing a bigger variety of assets, security tokens investors have the chance to own parts of an asset that may have been out of reach because of financial constraints

- Compliance: All security tokens follow regulatory requirements, therefore they offer a regulated framework that protects investors and gives them confidence in their investments

- Efficiency and speed: Security token trades can take palace around the clock, with near-instant settlements and automated compliance internationally for efficient and fast transactions

- Lower costs: Transaction costs may be cheaper than traditional fundraising and investment methods owing to a lot of third-parties being eliminated

- Diversification: Through STOs, investors have access to a broader range of assets, enabling them to expand and diversify their portfolios.

Examples of STOs

There are countless examples of successful STOs – each of which showcase diverse use cases and the ability to innovate capital markets globally. Here are some key examples.

Aquarius Fund

The Aquarius Fund is a premier security token for professional investors partially owing to its minimum investment limit being €125K.

Key takeaways:

- Targets optimization strategies, cash savings, and balance sheet management through stablecoin (USDT) lending

- Operates via the Luxembourg Fund structure to offer a secure and profitable product to attract investors

- Lends to select blockchain companies with solid reputations to mitigate counterparty risks

- Legal contracts back lending arrangements for a reliable and stable investment strategy

For those seeking high-yield investment opportunities, balance sheet management, and cash savings, the Aquarius Fund is a viable option.

Aquarius Fund focuses on risk management and liquidity by introducing easy access to stablecoin yields without the complexities often associated with direct crypto investments.

It ensures reliability and simplicity for investors wanting robust returns amidst traditionally low-interest environments.

USDT is the chosen stablecoin for the STO because it provides an inexpensive, highly secure, and fast exchange value. Stablecoins do not come with the volatility like other cryptocurrencies due to their value typically being pegged to the US dollar.

USDT serves as the most liquid crypto trading pair (i.e., BTC/USDT) for traders globally.STOKRThe Fund is tokenized on the sidechain of Bitcoin, Liquid Network. Investors can securely hold parts of the Fund within approved blockchain wallets to diversify investment opportunities.

Aquarius Fund’s investment opportunity is currently open-ended with a target return of 10% and Net Asset Value (NAV) currently at $8,580,201.

Investors can also peer-to-peer trade their fractionalized funds, with exchange listings also poised for the future for passive income.Asset type Debt Headquarters Luxembourg Management fee 1% of NAV Performance fee 20% Subscription period Monthly Minimum investment €125K (EUR, USDT, USD, EURT) Blockchain details Liquid Blockstream Mining Note

Blockstream Mining Note (BMN) gave investors the opportunity to invest in Bitcoin mining without having to purchase managing hardware through security tokens.

Key takeaways:

- BMN leveraged STOs to offer a stake in Bitcoin mining without hardware management being necessary

- It was a registered security that provided a fixed upfront cost to mitigate risks compared to other crypto investments

- Holders of BMN partook in a three year term to receive a stake of mined Bitcoin

- The security tokens are tradable on secondary markets, enhancing transparency and liquidity for investors

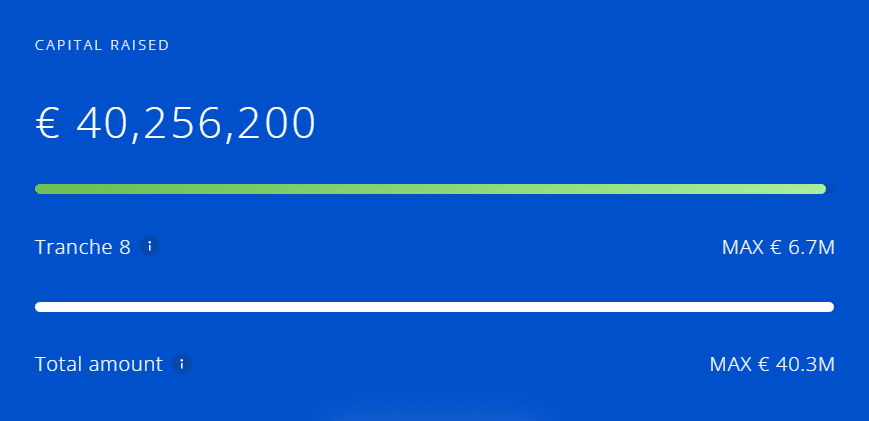

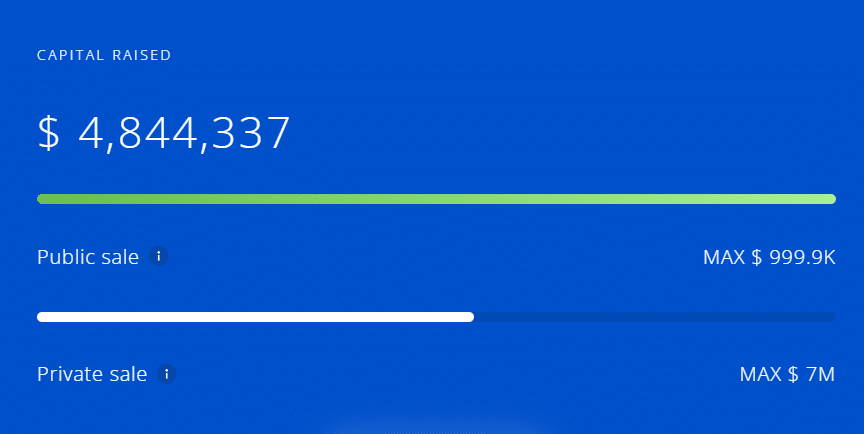

- It raised €40,256,200 from 77 investors, showcasing strong market interest in the initiate’s revenue-sharing model

BMN operated as a registered security and offered fixed upfront costs, removing typical hurdles faced when maintaining and purchasing mining hardware.

The project raised a whopping €40,256,200, with a total of 77 investors involved, who committed themselves to their investments for three years.

Industry Bitcoin mining Headquarters Montreal, Canada Token price €270K Minimum investment €270K Currencies accepted BTC, Liquid BTC, USDT Blockchain details Liquid Blockstream Asic

Blockstream Asic – a leader in Bitcoin infrastructure – is offering a distinct investment opportunity via Blockstream ASIC Note (BASIC Note).

Key takeaways:

- Investors can invest in Bitcoin mining machines and potentially profit if the crypto and STO market upswings

- ASICs within the mining schemes are being sold at a discounted rate so they can be resold for potential financial gain

- Investing via an STO means more regulation and security in comparison to unregulated cryptocurrencies and investment processes

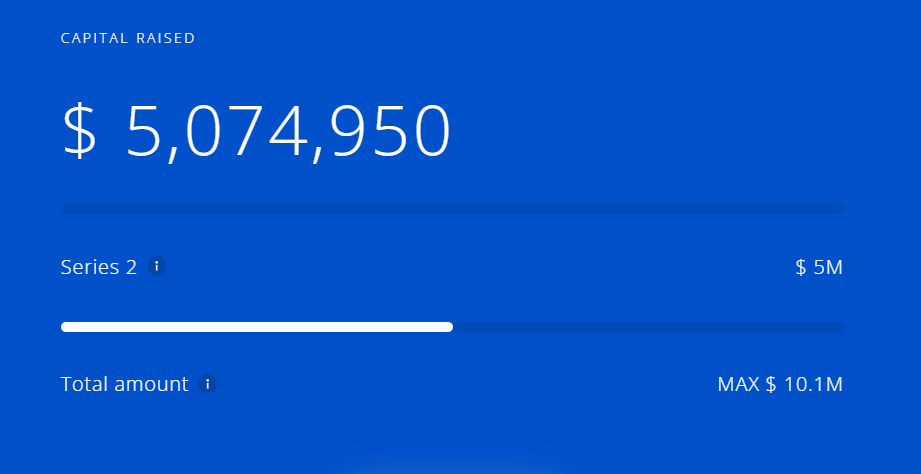

- The investment period is two years with a minimum investment of $115K

- $5M of its $10.1M target has already been raised

- Less than a month left until this investment opportunity closes

The STO initiative enables investors to have a stake in the Bitcoin mining equipment (ASICs) sector.

Rather than directly buying Bitcoin, investors can invest in Bitcoin minings machines at a discounted rate. By doing so, they can resell them once the market rebounds for potential financial gain. The minimum investment to partake in Blockstream’s STO is $115K for at least two years.

By leveraging its connections and experience to offer ASICs to investors, it has already raised $5M and is halfway to achieving its ambitious target of $10.1M.

Location North America Industry Bitcoin mining Token price $115K Stated maturity 2 years Minimum investment $115K ($5K for professional investors) Currencies accepted BTC, USDT, EUR Blockchain details BSIC1, BSIC2 La Boulangerie

Although this security token is no longer available, La Boulangerie is a fantastic example of a successful STO initiative.

Key takeaways:

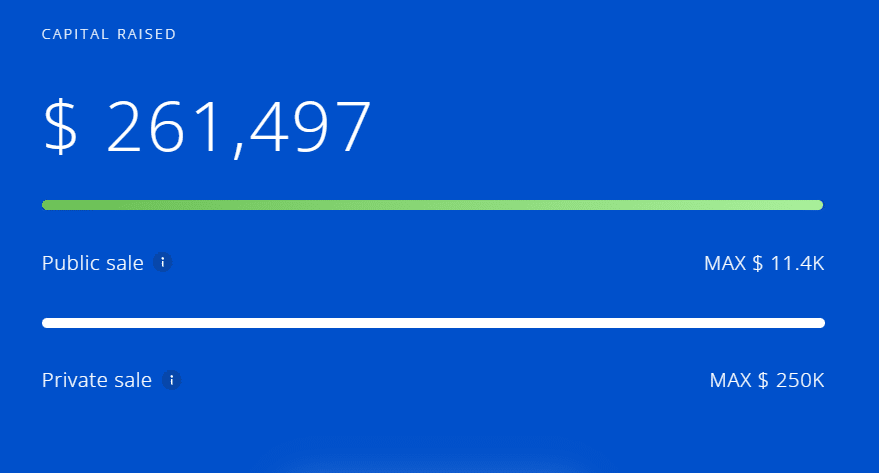

- La Boulangerie successfully raised $261,497 for its french bakery in Dubai in 2022 via STOs

- The ultimate aim of the security tokens was to bring new food and beverage experiences in the UAE

- Despite falling short of its $2.5M target, investors received 20% of the French bakery’s annual revenue

In 2022, La Boulangerie raised $261,497 to fund its French bakery in Dubai. The main aim of the security tokens funding was to bring new food and beverages to Dubai and ‘quality and standards unseen.’

Each investment multiplied depending on when the investments took place. Those involved received more when holding onto their investments for a longer period of time.

The rise in security token offerings allows investors of all sizes to have access to untapped potential and opportunities they may not have had easy access to before.La BoulangerieIndustry Food and beverage Location Dubai, UAE Token price $1 Minimum investment $100 Currencies EUR, USDT, BTC, USDT Blockchain details Liquid Infinite Fleet

Despite this fundraising initiative also being shut down, Infinite Fleet is worth highlighting owing to its unique use case.

Key takeaways:

- MMOG Infinite Fleet used STOs to raise capital

- Investors received a 20% share of the MMOG’s profits and payout upon exit

- The security tokens raised $4.8M with 935 investors partaking in the fundraising

Infinite Fleet is a massive multiplayer online game (MMOG) that raised capital on STOKR through its security token ‘EXOeu.’

The STO – also held on the Liquid network – gave investors the rights to a 20% profit share and an exit payout. Players of Infinite Fleet were able to become investors of the game and receive a share in its profit through the security tokens.

EXOeu was a success, raising over $4.8K from 935 investors in total.

Industry MMOG Token price $0.5 Minimum investment $100 Currencies EUR, USDT, BTC Blockchain details Liquid Cluster Farming

Coming up on STOKR is Cluster Farming, an STO initiative dedicated to promoting socio-economic and agricultural progress in Western Africa.

Key takeaways:

- Cluster Farming is raising an STO initiative in hope to raise $2M

- The funding will support sustainable catfish and poultry farming

- It will accept payments in USDT, BTC, and Euros

With the capital made from the upcoming security tokens, it will support independent farmers involved in poultry cultivation and catfish with technologically equipped hub farms.

It’s looking to raise $2M through the distribution of debt securities and provide a 4x return by the sixth year of the offering. Though, details currently remain scarce.

Industry Agriculture and aquaculture Maturity 6 years Minimum investment $10K Currencies USDT, BTC, EUR Blockchain details Liquid The STO Process

The STO meaning in business includes opening promising opportunities for entities wanting to fundraise in a regulated and transparent manner.

However, creating these safeguarded tokens involves technical know-how, legal expertise, and strategic planning to achieve a beneficial outcome.

Security tokens usually undertake numerous phases that boon projects and businesses raising capital, as well as their participating investors. Such phases include:

Phase 1: Preparation

To get started, STO developers typically create a business plan and develop a deck, which generally consists of funding requirements and market valuations to attract investors.

During this phase, STO creators need to check out necessary compliance, which changes depending on the tokens’ jurisdiction and its nature.

Creating a security token requires comprehensive preparation to meet regulatory and legal standards.Phase 2: Creating the Offering

During the offering phase, issuers normally define the token’s structure, including elements like its quantity, value, rights, capitalization, and market duration.

During this time it’s important to select the token’s jurisdiction while considering the legal guidance and progressions necessary for regulatory compliance.

Phase 3: Selection of Service Providers

Phase 3 is a good time for STO issuers to select their security token offering platform and its preferred blockchain to develop and issue their STOs.

At this stage, service providers are usually appointed to custody underlying assets, distribute tokens, and manage cash flow.

Two notable examples include Daura, which targets small and medium enterprises in Switzerland, and Capexmove, which specializes in digitizing debt.

Brokers play a critical role in executing due diligence on the STO creator’s and investors’ information to ensure precision and completeness for a successful outcome.

Phase 4: Fundraising

Issuers can engage and identify investors through meetings, roadshows, and deck distribution by working closely with brokers.

Marketing regulations will likely need pre-approval from authorities in accordance with their governance laws during this phase.

Phase 5: Trading Listings

After issuance, the STO is usually transferred to a ‘Special Purpose Vehicle’ (aka SPV) to be listed on a trading platform.

Additional marketing efforts may be undertaken to enhance liquidity.

Security Token Exchanges

There are many exchange companies with a variety of STO opportunities, including:

Securitize

Securitize pioneers digital securities. With 500K users and counting, it tokenizes leading assets for BlackRock, KKR, and SPICE, among others.

In 2021, the platform expanded by debuting ‘Securitize Markets,’ which offers both a primary market and a secondary market that operates like traditional exchanges for peer-to-peer trading.

It is notably registered with the SEC and FINRA to safeguard market integrity. It is a member of SIPC, a non-profit organization that has been protecting investors for over 50 years.

- Grants 24/7 access to STO investments with seamless trading opportunities and transfers on the secondary market

- Leverages Securitize Credit to enable investors to borrow tokenized securities, opening new liquidity avenues

- Provides efficient access to funds through automated redemptions via web3 smart contracts

- Bespoke investment plans to tailor to a diverse range of businesses to help meet their financial needs and goals

INX

INX is the first platform for trading security tokens in the US. SEC-registered tokens are available for trading on a liquid market 24/7.

It opens exclusive STO opportunities for investors before hitting the secondary market and works alongside some of the largest financial institutions, including Barclays, Morgan Stanley, and JP Morgan Chase & Co.

- Its US-regulated platform opens access to both crypto and security tokens registered by the SEC for security and compliance

- Enables users to partake in STOs before becoming available on the secondary market in a bid to enhance investment returns

- All tokens on the platform can be traded around the clock, meaning investments can be managed at any time, anywhere

- Has high regulatory oversight and security measures, including SEC and FINRA licenses to ensure the trust and safety of funds and transactions

MERJ

Merj is an international securities exchange held in the Republic of Seychelles since 2011.

The platform combines traditional and digital securities while ensuring each asset is regulated.

It supports numerous asset classes, bridging conventional assets with the digital world through blockchain technology for transparent, secure trades worldwide.

- Provides entry to an international investor audience spanning from institutions to retail investors

- Offers professional, fast, and efficient listening processes

- Supports issues of both traditional investments and security tokens around the world

STOs vs ICOs: What’s The Difference?

People typically confuse STOs with ICOs. However, ICOs address utility tokens while lacking governance, while STOs are governed by security regulations, making them a safer option for companies wanting to attain financial backing.

STOs were designed as a response to the ICO bubble burst in 2018. When the market cap of cryptocurrencies fell by over $750B, regulatory bodies began looking into more secure legislation for STO blockchain tokens.

Features STOs ICOs Legal compliance Governed by securities laws and regulations. Not subject to regulations Primary assets Represent ownership of real-world assets Often represent tokens with utility for a platform, but not always Investor security Increased security measures owing to compliance Higher risk because of less protection Market outlook Generally considered more trusted and credible Known for being high-risk and speculative Pros and Cons of STOs

STOs offer numerous benefits for businesses and investors alike, owing to reshaping asset ownership and fundraising. While their advantages are far-reaching, STOs are not without their challenges:

Pros

- Regulatory compliance: STOs are a safer investment methods because they adhere to government requirements

- Asset-backed value: Backing real-world assets means enhanced transparency and stability for investments

- International investor base: Businesses can raise capital through a global pool and around the clock while being regulated, regardless of time zones

- Fractional ownership: By enabling fractional ownership of more assets, STOs make investments more accessible to small-scale investors because of being a fraction of the price

- Investor rights and protection: Blockchain technology securely records all transactions and ownership and is tamper-proof, giving investors more security when compared to traditional models that can be mismanaged and lack transparency because of human error.

Cons

- Market volatility: The value of security tokens is not protected from crypto market fluctuations

- Security concerns: Must have full trust in the platform trading and issuing the token, ensuring it’s not being traded without the consent of all parties involved.

- Lack of Standardization: STO regulations change depending on region – this can create uncertainty and complexity for both the creators and investors if they do not do their due diligence

- Restricted liquidity in secondary markets: Limited liquidity can result in price volatility, making it tricky for investors to trade their assets at their desired prices

- Higher cost: Both STOs and conventional methods can incur fees because of regulatory filing, legal fees, and regulatory compliance.

- Complexity: STOs may be confusing for those without technical know-how and blockchain knowledge, so they may need to pay someone skilled in the area for assistance

Challenges of STO Development

Investor accreditationIn some jurisdictions, investors are only able to invest in an STO if meeting specific net worth or income requirements. Verifying investors can be a challenge because of potential resource constraints, contrasting regulatory frameworks, privacy concerns, and being resource-intensive.

Lack of classification and definitionSTOs are relatively complicated compared to traditional methods like paper certificates – especially for those who aren’t tech-savvy and without blockchain knowledge. Education about security tokens is crucial for greater market adoption.

Paper-based processesYour browser cookies can reveal your real location, tipping the platform off about IP discrepancies. Delete your cookies and cache in your browser settings, and try again.

Crypto-related intermediary regulationFinancial authorities set requirements for licensing and registering STOs, which can be stringent depending on the jurisdiction.

Limited liquiditySTOs secondary market liquidity can be limited, which can erase investor confidence and might make the token face sudden price swings.

Technical expertiseFor both the company and the end user, leveraging blockchain technology and smart contracts for security tokens requires technical knowledge. Blockchain systems’ security, scalability, and interoperability can be complex to understand.

Legal protection of crypto assetsLegal protection for STOs includes compliance with numerous securities regulations, addressing smart contract reliability, managing cross-border issues, etc.

Risk management and market volatilityThe crypto market is prone to being highly volatile. STO issuers must communicate transparency with their investors and execute risk management strategies to reduce potential losses of funds and garner trust.

Simply put, STO development involves more strategic planning, effective investor engagement strategies, robust technological infrastructure, and regulatory compliance.

The Future and Growth of STOs and STO Platforms

STOs innovate conventional investment strategies through the tokenization of real-world assets via tamper-proof blockchain technology.

Security tokens provide shared ownership in a diverse range of assets, including real estate, commodities, and art. They make investments easily accessible to investors worldwide.

The STO sector is poised for growth, with current security token initiatives like Blockstream Mining Note and Aquarius Fund demonstrating thriving capital rises through their tech-savvy investment models.

As more STO initiatives arise, they aim to reshape capital markets through blockchain’s security and efficiency, potentially making investments of traditional assets more seamlessly managed, traded, and secured digitally.

FAQs

How does a Security Token Offering work?

An STO features ownership of an asset, like a firm’s equity or debt. Operating on the blockchain ecosystem ensures transparency and secure transactions.

Each token is identifiable and complies with regulatory requirements. By digitizing conventional securities, they enable fractional ownership of real-world assets, international accessibility, and quicker settlement times for investment opportunities.

Simply put, security tokens enhance how assets are typically distributed, traded, and overseen in the digital world.

What is an example of a security token?

One example of a security token includes asset-backed tokens, which represent fractionalized ownership of real-world assets like real estate or art.

Asset-backed tokens close the divide between traditional ownership and digital ownership, offering enhanced flexibility, accessibility, and transparency for investors through all investment and product information being secured on the blockchain, thus making them tamper-proof.

What is the difference between ICO and Security Token Offering?

Unlike Initial Coin Offerings (ICOs), STOs offer investors legal rights and protections due to being subject to securities regulation.

Because STOs can offer voting rights, dividends, and ownership records, the latter provides a more compliant and secure alternative to the former.

What is the meaning of a token offer?

A token offer signifies digital tokens on the blockchain ecosystem. They can represent numerous assets within a decentralized network.

Token offers enable capital-raising through ICOs and STOs, where tokens are digitally sold to investors in return for fundraising a project or business. Though different owing to governance rights, they both utilize blockchain technology.

References

Click to expand and view sources- What is a Security Token Offering (STO)? (Hedera)

- What is a Security Token Offering (STO)? (Cloud Security Alliance)

- Everything You Need to Know About STO Development: A Comprehensive Guide (Medium)

- Howey Test Definition: What It Means and Implications for Cryptocurrency (Investopedia)

- Security Token Offering (Wikipedia)

- Aquarius Fund (STOKR)

- Blockstream Mining (STOKR)

- Blockstream Asic (STOKR)

- La Boulangerie (STOKR)

- Infinite Fleet (STOKR)

- Tokenization Market Size, Share & Industry Analysis (Fortune Business Insights)

- The Tokenization Process (Securitize)

- What Is a Blockchain Node? (The Motley Fool)

- Benefits of Fractional Ownership Through Tokenization (Brickken)

- Hong Kong’s Crypto License Extends Beyond Capabilities Of Permits Provided In US And Singapore, Says HKbitEX Co-founder (99 Bitcoins)

- Barriers to Entry: Understanding What Limits Competition (Investopedia)

- What is SEC STO? How Can KYC for STO help? (HyperVerge)

- Foreign investors find it hard to invest in Indian government bonds due to heavy paperwork: Report (Hindustan Times)

- Overview of the ST-20 Interface and Polymath Core (Medium)

- Digitising Capital Markets (Capexmove)

- Your company on the digital market (Daura)

- What Is a Special Purpose Vehicle (SPV), and Why Do Companies Form Them? (Investopedia)

- Security Tokens — Voting Rights and Governance (Medium)

Our Editorial Process

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.Leah Alger Senior Crypto Journalist

Leah is a seasoned British journalist with nine years of expertise who specializes in web3 reporting.Her insightful contributions have graced the pages of respected publications such as NFT Plazas, Bitcolumnist, NFT Lately, Cointelegraph, and Coinbound, among others.With a keen eye for detail, she offers distinct perspectives on the ever-evolving landscape of blockchain technology.View all posts by Leah AlgerMore Crypto Learning Hub – Guides, Research, and Latest Crypto Tech Explained GuidesView all

Latest News

Elon Musk to Move X and SpaceX Headquarters from California to Texas

On Tuesday (July 16), Elon Musk announced that he’s moving the headquarters of his companies X and SpaceX from California to Texas. While SpaceX is moving to Starbase (a company...

AI Startup Anthropic and Menlo Ventures Join Hands to Launch a $100 Million Startup Fund

AI startup Anthropic and its biggest investor Menlo Ventures are launching a $100 million startup fund that will be used to back new startups. Menlo will supply the cash to invest...

REGULATION & HIGH RISK INVESTMENT WARNING: Trading Forex, CFDs and Cryptocurrencies is highly speculative, carries a level of risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. Please note that we do receive advertising fees for directing users to open an account with the brokers/advertisers and/or for driving traffic to the advertiser website.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© Copyright 2024 The Tech Report Inc. All Rights Reserved.

Scroll Up