Tech Report is one of the oldest hardware, news, and tech review sites on the internet. We write helpful technology guides, unbiased product reviews, and report on the latest tech and crypto news. We maintain editorial independence and consider content quality and factual accuracy to be non-negotiable.

Crypto has received a lot of attention over the past few years, but not always positively. Unfortunately, the rapid adoption of crypto and the growing number of prospective investors have paved the way for the biggest crypto scams, which have cheated people out of billions.

Even Netflix released a crime documentary about crypto fraud in 2024. With Bitconned quickly gathering more views and coverage about Centra Tech, it seems more people are learning about the potential of insidious crypto scams.

For those interested in other major past cases of crypto fraud, we compiled this list of the biggest crypto scams ever recorded. Keep reading to learn how the biggest crypto fraudsters conned thousands of people, plus tips on how to stay safe when investing.

-

-

The Biggest Crypto Scams of All Time – Key Takeaways

- The biggest crypto scam to date swindled investors out of $8 billion in three years.

- Stablecoins make up nearly 75% of all illicit crypto transactions.

- On average, victims lost a collective $6 billion/year globally to crypto scams throughout 2018–2023.

- Rug pulls and Ponzi schemes were the biggest crypto scams by revenue in 2017–2021.

- The biggest crypto scams recorded operated for years, but the lifespan of the average crypto scam reached a record low of 70 days in 2021.

- Globally, revenue generated by crypto scams has been going down since 2021, but Americans are increasingly targeted.

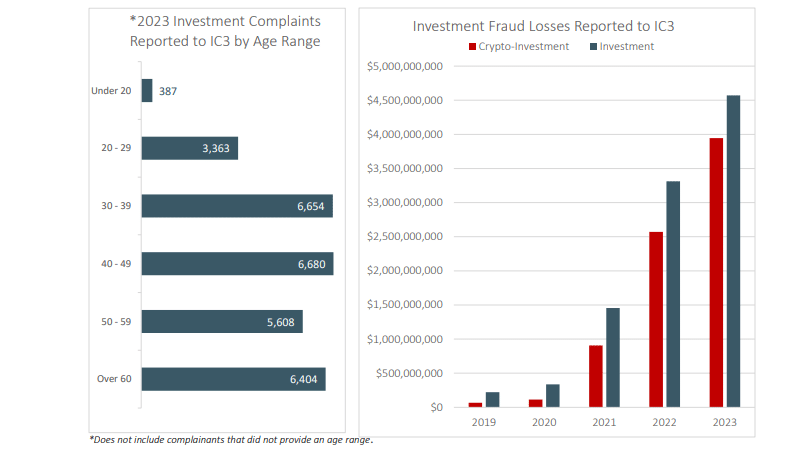

- FBI reports show crypto investment fraud was up 183% in 2022, and 53% in 2023.

- Americans aged 30-49 and seniors are the most common targets of crypto fraud.

- The median loss to crypto scams in the US was $3,800 in 2023.

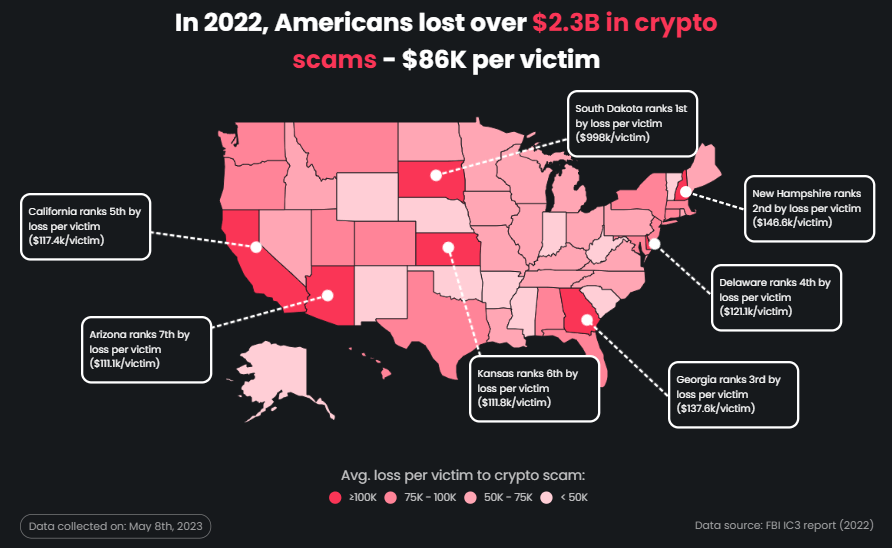

- South Dakota had the highest average loss of $998k per victim in 2022, followed by New Hampshire, Georgia, and Delaware at over $120k.

The Biggest Crypto Scams of All Time Ranked

We reviewed all the cryptocurrency-related press releases published by the US Department of Justice and selected the biggest crypto scams based on the reported financial damages.

Note that some of the charges covered below are based on indictments and cannot be counted as evidence of a committed crime. But without further ado, here are the biggest crypto scams ever reported from 2013 to date.

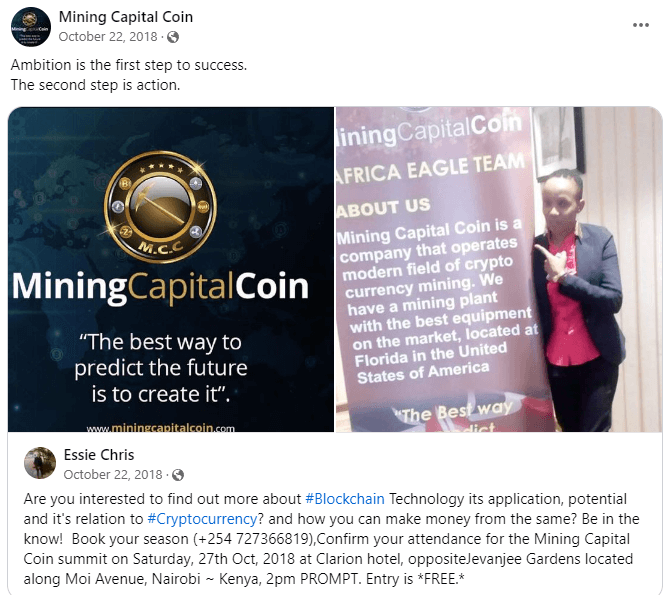

10. Mining Capital Coin

The damages: $62 million

Mining Capital Coin (MCC) was a purported crypto investment and mining platform that promised guaranteed returns for its investors who bought ‘mining packages.’

According to the SEC, MCC had over 65,000 investors at its peak.As per an SEC litigation release, MCC claimed to run extensive crypto mining and automated trading operations. The platform could allegedly offer investors a 1% daily profit-sharing return who lend their funds to support said mining and trading farms.

The promised returns would translate to weekly payouts of up to $84,000 for the ‘MVP Royal Package’ investors. The platform also allegedly ran a pyramid scheme, encouraging ‘sponsors’ to promote MCC’s mining packages for a promised 10% commission.

However, MCC reportedly had no mining farm or automated trading bots to invest the funds as promised. Instead, Florida CEO Luiz Capuci Jr. allegedly appropriated the investors’ money and defrauded clients of $62 million.

MCC also promoted its own token and trading platform to clients. Although investors were initially promised returns in Bitcoin, the platform later had them withdraw their returns in Capital Coin (CPTL).

Investors would have to redeem their CPTL on Bitchain, a fake crypto trading platform created by Capuci. However, users encountered purported errors that made it impossible to exchange their tokens.

According to the US Department of Justice, Capuci later attempted to launder the collected funds through foreign crypto exchanges. Shortly after the investigations began, Capuci fled to Brazil. Shortly after, the SEC initiated an enforcement action to freeze his assets.

After his 2022 indictment, Capuci was charged with conspiracy to commit securities fraud, wire fraud, and international money laundering. As of today, the FBI Miami Field Office is still investigating the case. In April, 2024, Capuci lost the appeal over his frozen assets.

9. EmpiresX

The damages: $100 million

EmpiresX ran a global cryptocurrency investment fraud scheme that amassed approximately $100 million from investors throughout 2020–2022. The Florida-based EmpiresX platform claimed to run as a hedge fund, touting a guaranteed 1% daily profit on lent funds.

EmpiresX claimed to use its own AI-powered trading bot plus the help of a licensed trader to maximize trading profitability. However, according to a press release from the US Department of Justice, EmpiresX would not actually operate as an investment platform.

In reality, EmpiresX ran a Ponzi scheme by diverting funds from newcomers to earlier investors. The said trading bot was fake, and the manual trading brought significant losses. EmpiresX founders also misappropriated large sums of investors’ money for personal use.

According to the DoJ, EmpiresX also falsely claimed to have registered its investment program as an offering and sale of securities with the SEC, likely as a way to garner investors’ trust.

In 2022, the ‘Head Trader’, Joshua David Nicholas, pleaded guilty to conspiracy to commit securities fraud. In 2023, Nicholas was sentenced to 51 months in prison, followed by three years of supervised release. He was also ordered to pay $3,379,527 in restitution.

Founders Emerson Sousa Pires and Flavio Mendes Goncalves were also charged with running the fake trading scheme, though the two fled the US and were declared fugitives. Pires and Goncalves were also ordered to pay over $45 million in disgorgement, prejudgment interest, and civil penalties.

In 2024, the US District Court released a consent order imposing fines totaling $64,356,794 and permanently prohibiting EmpiresX from engaging in further CFTC violations.

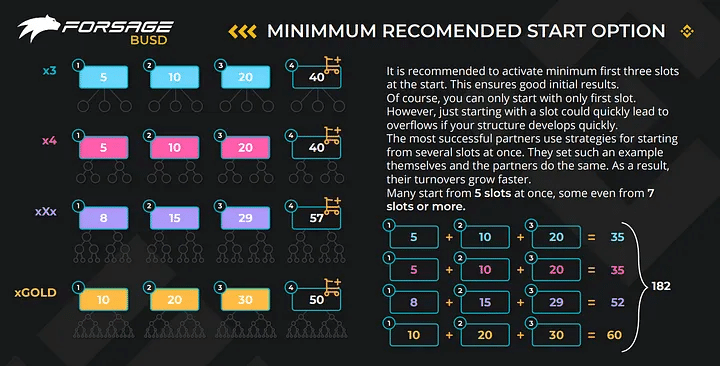

8. Forsage

The damages: $340 million

Forsage was the first charged criminal case involving DeFi fraud.Forsage was a purported decentralized finance (DeFi) crypto platform on the Ethereum, Binance, and Tron blockchains. It worked based on blockchain smart contracts, which, in theory, would ensure complete transparency and security for the platform’s investors.

Based on these smart contracts, Forsage promoted itself as a secure and lucrative investment opportunity and claimed to work as a marketing matrix and business partnership network with built-in reward distribution.

However, the platform’s founders were later indicted in February 2023 for allegedly running a global Ponzi and pyramid scheme that gathered roughly $340 million from investors.

Source: Medium An analysis of the smart contracts reportedly found that Forsage automatically diverted new investors’ funds to earlier investors up the ladder.

Furthermore, according to the DoJ, over 80% of investors received fewer ETH than invested, with over 50% getting no payout. As stated in court documents, Forsage’s xGold ETH smart contract also redirected investors’ funds into the founder’s crypto accounts.

Forsage’s founders – Vladimir Okhotnikov, Olena Oblamska, Mikhail Sergeev, and Sergey Maslakov – were each charged with conspiracy to commit wire fraud and could face up to 20 years in prison if convicted.

The FBI and HSI are investigating the case. As of 2024, the DoJ still receives Victim Impact Statements from Forsage investors.

7. HashFlare & Polybius Bank

The damages: $575 million

HashFlare and Polybius Bank were two allegedly fraudulent operations by Estonian founders Sergei Potapenko and Ivan Turõgin. The two were indicted in 2022 after reportedly defrauding over $575 million out of hundreds of thousands of international victims.

HashFlare

HashFlare reportedly ran a Ponzi scheme, diverting money from newer to earlier investors.HashFlare reportedly claimed to run a massive crypto-mining operation. Their online platform would sell ‘rental contracts’ for their mining equipment as an investment opportunity. Throughout 2015–2019, the platform amassed over $550 million from its investors.

For a fee, clients could rent a percentage of the mining operation and receive the cryptocurrency produced by their rented machines. According to the DoJ’s press release, the HashFlare website also lets investors see the purported amount of crypto mining.

However, the massive mining operation was allegedly fake, and HashFlare was actually mining Bitcoin at a rate less than 1% of what was promised. Some of the investors who tried withdrawing their funds were reportedly denied payment.

Source: CoinCentral Polybius Bank

In 2017, Potapenko and Turõgin promoted Polybius as another promising investment, successfully raising at least $25 million from unsuspecting victims.

The company claimed to use the funds to open a crypto bank and would pay the investors dividends from its profits. The fundraiser seems to have been an exit scam; as per the DoJ, Polybius would never form a bank or pay back its investors.

The founders tried to launder the illicit funds through various shell companies, allegedly hiding the money in multiple cryptocurrency wallets and thousands of crypto mining machines alongside multiple luxury cars and real estate properties.

Potapenko and Turõgin were arrested in Estonia and charged with 16 counts of wire fraud, plus two additional counts of conspiracy to commit wire fraud and money laundering. If convicted, the two could face up to 20 years in prison.

The FBI is still currently investigating the case, and seeking victim information from those affected by HashFlare or Polybius wire fraud.

6. BitClub Network

The damages: $722 million

BitClub Network was active from 2014 to 2019 and marketed itself as an innovative mining and investment platform. BitClub investors could buy shares in three so-called crypto mining pools, supposedly earning part of the crypto mined by the platform.

BitClub Network misappropriated at least $722 million worth of BTC from its investors.However, the multiple mining pools and earning figures displayed on the platform were misleading. As per a 2020 IRS release, one of the scheme’s operators, Silviu Catalin Balaci, admitted he was not aware of BitClub Network ever operating multiple mining pools.

Balaci also admitted the platform would periodically change the figures displayed as BTC mining earnings to make it seem like BitClub had higher returns than it actually did. BitClub also ran a pyramid scheme, promising rewards to those who brought in new users.

According to the US Department of Justice, four of the scheme’s orchestrators also conspired to sell BitClub Network shares without disclosing that their securities were never registered with the SEC.

Source: 99Bitcoins In December 2019, five defendants were charged by indictment in connection with BitClub Network’s multiple schemes. In 2020, Balaci, Jobadiah Sinclair Weeks, and Joseph Frank Abel pleaded guilty to wire fraud and conspiracy to sell unregistered securities.

In a subsequent 2022 court hearing, BitClub investor Gordon Brad Beckstead and the network’s creator Matthew Brent Goettsche both pleaded guilty to conspiracy to commit money laundering.

Beckstead also pleaded guilty to aiding in the preparation of a false tax return, which allowed Goettsche to avoid paying over $20 million in federal income tax.

While further case updates are underway, the US DoS is still receiving information from BitClub fraud victims via its online questionnaire.

5. HyperFund

The damages: $1.89 billion

HyperFund, also known as HyperCapital, HyperTech, HyperNation, and HyperVerse, was another purported crypto mining and investment platform that reportedly defrauded investors of roughly $1.89 billion from 2020 to 2022.

According to a USAO press release, HyperFund operators fraudulently claimed investors would earn substantial returns by supporting the platform’s mining operations, although said operations didn’t exist.

HyperFund allegedly claimed that investors who purchased investment contracts would receive 0.5–1% daily returns to double or triple their initial investment. However, the platform reportedly blocked investors’ withdrawals, denying them access to their funds.

Three were charged with the alleged scam in 2024. Australian national Sam Lee was indicted for his role as the main founder of HyperFund. If convicted, he could face a five-year sentence for conspiracy to commit wire and securities fraud.

Brenda Chunga, Maryland, pleaded guilty to being a co-conspirator and promoter of the scheme. She admitted to receiving at least $3 million for conducting online investor meetings to promote HyperFund. If convicted, she could face a five-year sentence.

Rodney Burton, Florida, was also charged with a criminal complaint for allegedly promoting the scheme. The IRS-CI and HSI are still investigating the case, and the federal district court has yet to determine any sentence.

4. BitConnect

The damages: $2.4 billion

BitConnect was a purported crypto investment platform with its own digital token, BitConnect Coin (BCC). At its peak, BitConnect had reached a market capitalization of $3.4 billion and even achieved meme status. Nowadays, it’s known as one of the biggest crypto scams.

Source: Influencer Marketing Hub BitConnect was active between 2016–2018 and marketed its purported crypto lending program as a safe investment with guaranteed 40% monthly returns.

In 2022, BitConnect founder Satish Kumbhani was indicted for orchestrating a global Ponzi scheme.The platform supposedly generated significant profits using its own trading bot and ‘volatility software.’ However, according to a court indictment, BitConnect was a textbook Ponzi scheme.

The platform allegedly paid later investors’ money to earlier investors, collectively defrauding clients of roughly $2.4 billion. The lending services abruptly shut down in 2018 under the guise of ‘continuous bad press’ and ‘attacks from hackers.’

Source: Bitcoin News The platform also promoted its own cryptocurrency as a payment method for investors. The project attracted a sizable user base with its initial coin offering in 2016, even though BitConnect never registered with FinCEN as required by law.

BCC even became the 8th best-performing currency on CoinMarketCap at some point in 2017. But part of BCC’s popularity was likely due to alleged price manipulation, which created the illusion of increased market demand.

Kumbhani could face a 70-year prison sentence if convicted of his charges, which include: wire fraud, conspiracy to commit commodity price manipulation and international money laundering, and the operation of an unlicensed money transmitting business.

3. Thodex

The damages: $2.6 billion

Thodex was one of the leading crypto exchange platforms in Turkey and internationally, having reached over 390,000 active users before its abrupt closure in 2021. At its peak, the platform was active in 120+ countries and had over 177 monthly transactions per user.

According to the prosecutor’s opinion, Thodex initially executed legitimate crypto exchanges to gain investors’ trust, but its intention was always to defraud customers. Later, the platform generated fake values for the supposedly executed crypto transactions.

Source: Platinonline In 2021, Thodex organized an extensive promotional campaign, promising it would distribute 2 million Dogecoins, with 150 coins going to each new user. After this campaign, the platform’s users started experiencing issues when trying to exchange or withdraw their crypto.

Shortly thereafter, Thodex founder Faruk Fatih Özer announced the platform’s ‘temporary closure’ and fled Turkey with an estimated $2 billion worth of investors’ funds. Though the real extent of the damage is unknown, Chainalysis estimates the value of lost crypto at $2.6 billion.

Özer and his co-conspirators were arrested in 2022, and the case was judged in Turkey in 2023. Özer was charged with multiple crimes, including fraud and the organization and management of a criminal group. He received an 11,196-year prison sentence.

However, Özer didn’t plead guilty. He reportedly told the court that he ‘wouldn’t act so amateurishly’ if he were to establish a criminal group and that he ‘possesses the intelligence to lead any institution globally,’ pointing to his obviously successful venture as proof.

2. OneCoin

The damages: $4 billion

Up until recently, OneCoin was the biggest crypto scam in history.Beginning in 2014, OneCoin was a fraudulent cryptocurrency promoted and sold through a global MLM scheme. Before ceasing its operation in 2017, OneCoin had defrauded millions of victims of over $4 billion.

According to US Attorney Damian Williams, OneCoin founders lured unsuspecting victims with promises of a ‘financial revolution’ and claims of dethroning Bitcoin as the leading cryptocurrency. In actuality, OneCoin’s crypto packages were entirely worthless.

Source: Капитал (Capital) An email exchange cited by the DoJ shows that the project founders distributed 1.3 billion fake tokens in 2015 alone. OneCoin also lied to its investors about the token’s valuation, claiming the price was based on market supply and demand.

However, the founders set the coin’s value arbitrarily to fabricate the illusion of steady growth. To ensure investor trust, OneCoin made further fraudulent claims about its token utility, its purported dedicated blockchain, and crypto mining operations.

In 2017, co-founder Ruja Ignatova (also known as ‘Cryptoqueen’) was charged with fraud and money laundering. Ignatova became a fugitive and was later added to the FBI’s Top Ten Most Wanted list.

Meanwhile, her co-conspirator, Karl Sebastian Greenwood, was already arrested and sentenced to 20 years in prison for fraud and money laundering. A 2024 data leak uncovered Ignatova’s money trail from OneCoin to Dubai.

1. FTX & Alameda Research

The damages: $8 billion

Active throughout 2019–2022, FTX was a purported cryptocurrency trading platform.Samuel Bankman-Fried, founder of FTX and Alameda Research, has been the most talked-about figure in the crypto space lately; and for all the wrong reasons. In 2023, his venture was described as ‘one of the biggest financial frauds in American history.’

According to a 2024 US DoJ press release, Sam Bankman’s scheme swindled customers of over $8 billion in one of the most complex cases of crypto fraud orchestrated to date.

Before its abrupt bankruptcy in late 2022, FTX was actually the second-largest crypto exchange on the market. Alameda, a so-called crypto hedge fund, was connected to FTX as a purported customer of the platform.

Source: Fox Business FTX’s popularity undoubtedly contributed to its perceived legitimacy. By extension, FTX’s solid reputation would also attract potential investors to its sister company, Alameda. Moreover, according to indictment papers, Bankman repeatedly and falsely claimed that:

- FTX deposits were kept safely and would not be used by FTX.

- Customers’ deposits were kept separate from company assets.

- Alameda didn’t have privileged access to FTX funds.

However, as testified by Bankman’s co-conspirators, Alameda actually siphoned more than $1.7 billion from customer deposits, having access to unlimited FTX withdrawals. Alameda also defrauded its direct investors of more than $1.3 billion.

Alameda lenders and FTX equity investors received false financial statements with inflated revenue and profit figures that covered Bankman’s misuse of customer funds. The stolen money went to private investments and $100 million worth of political contributions.

Bankman was found guilty of multiple counts of wire fraud, conspiracy to commit wire and securities fraud, and conspiracy to commit money laundering. In March 2024, he was sentenced to 25 years in prison and ordered to pay over $11 billion in forfeiture.

The Latest Stats on Crypto Scams – A Worrying Trend

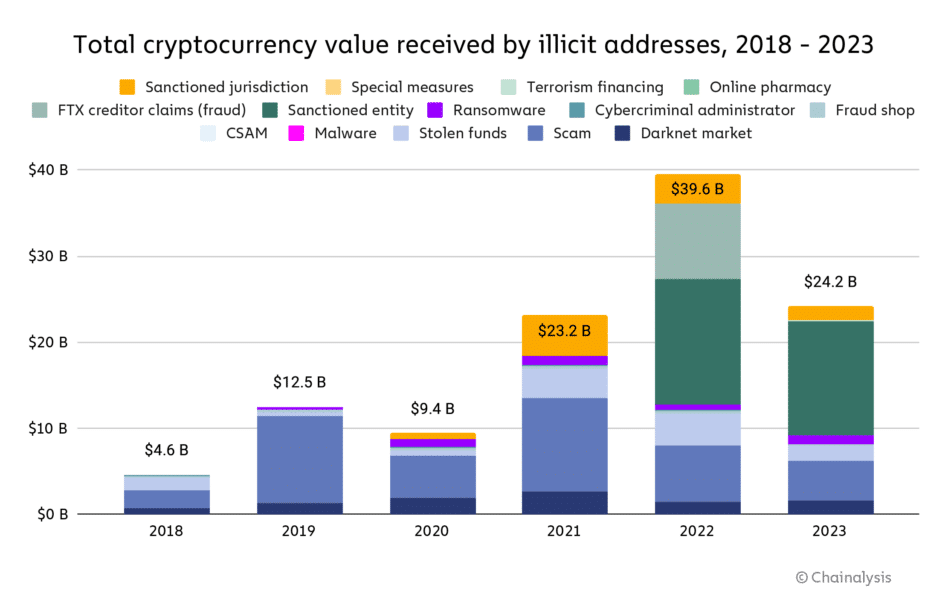

The biggest crypto scams to date back to 2014, though some were active as late as 2022 when crypto fraud reached its peak.

A Chainalysis investigation showed a particularly abrupt rise in crypto received by illicit addresses in 2022 when the estimated value reached an all-time high of $39.6 billion.

Source: Chainalysis Chainalisys also revealed the types of crypto most frequently used for illicit transactions. For scams, stablecoins made up nearly 75% of the transaction volume, followed by Bitcoin at nearly 25%.

But these are just the lower estimates based on a number of newly identified and highly active addresses. According to Chainalysis, the real figures could likely be higher.

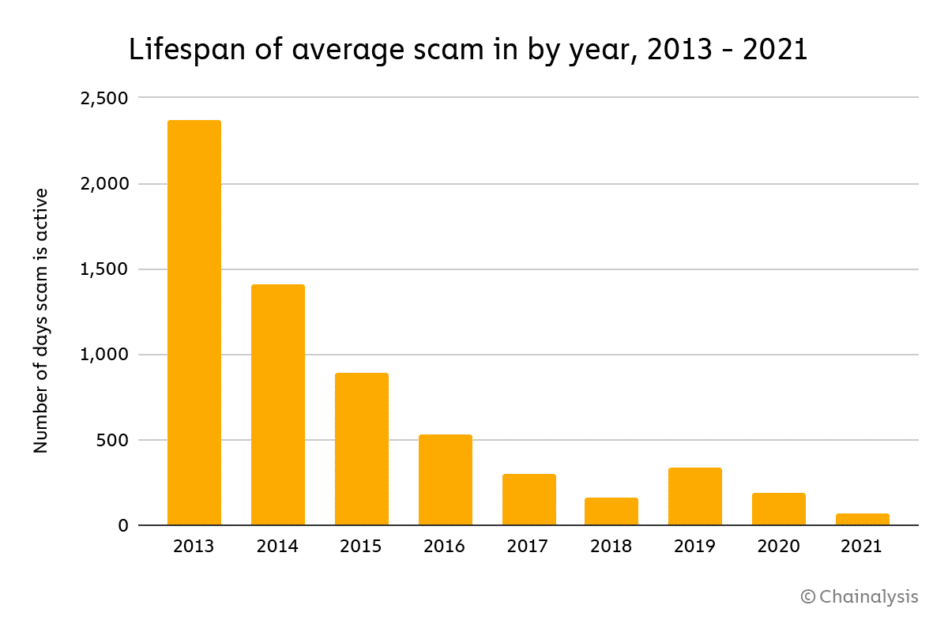

Crypto Scams Going Down Globally After 2021 Peak

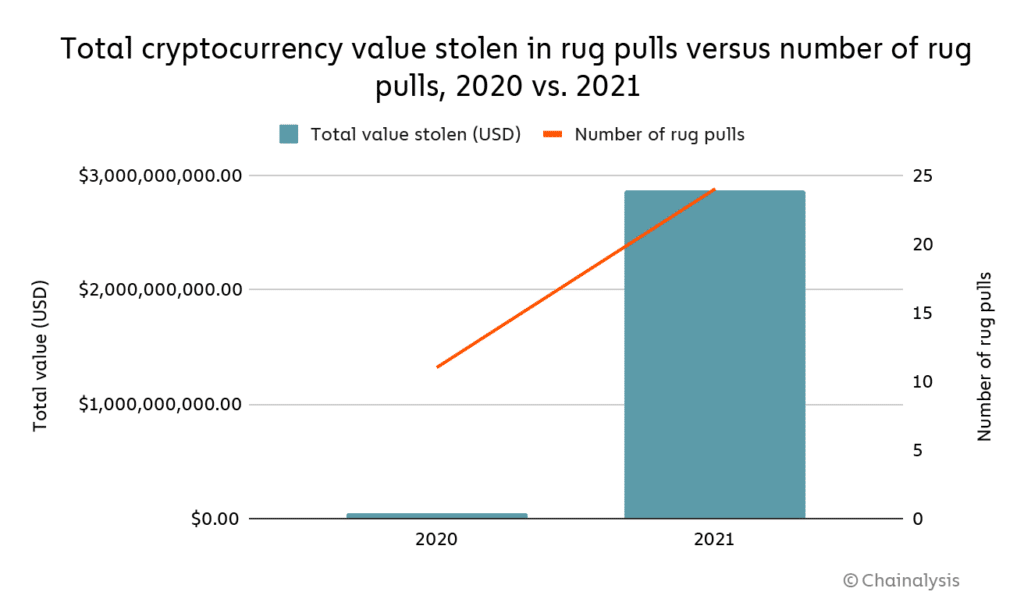

In 2019 and 2021, scams amassed values surpassing $10 billion, with Ponzi schemes and rug pulls being the largest contributors to scam revenue.

As older Chainalysis findings show, the number of scams had been steadily increasing until 2021, while the lifespan of the average scam fell to a record low of 70 days.

Source: Chainalysis However, illicit funds coming from scams have been going down recently. Scams are still the third leading contributor to crypto crime revenue, though ransomware attacks saw the biggest rise in 2023.

Crypto Scams Still Targeting a Growing Number of US Investors

Despite a downward global trend in crypto scam revenue, a 2022 FBI report found different figures in the US. Americans appear to be increasingly targeted by crypto scams, especially investment fraud.

Based on the number of reports registered by the IC3, crypto investment fraud was up 183% in 2022, when it reached a peak of $2.57 billion.

Some of the most commonly reported types of crypto investment scams were fraudulent liquidity mining apps, real estate investment opportunities, and fake employment offers.Again, in 2023, the FBI reported a further 53% growth in crypto scams, which reached a new high of $3.94 billion. Based on the number of reports, the most common targets of crypto investment scams were aged 30-49, followed closely by those over 60.

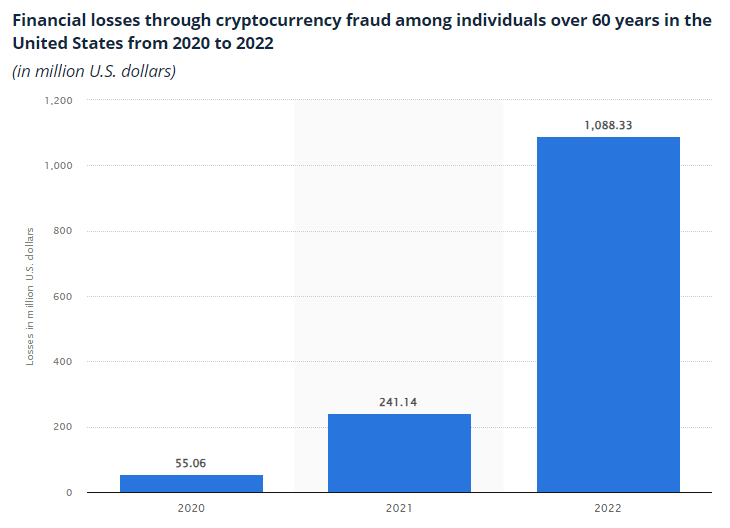

Source: KTLA5 US seniors, in particular, have been increasingly losing money to crypto fraud. Over the past few years, the recorded financial losses in this group were up +1,877%. In 2022, crypto scams were the #2 financial crime affecting US adults aged 60+.

Source: Statista How Much Have People Lost in Crypto Scams?

While we don’t have an actual figure, Chainalysis global estimates suggest crypto scammers have been cashing in around $6 billion per year on average between 2018–2023. And a large share of crypto scam losses affect US citizens.

In 2021, an FTC report showed that more than 46,000 US victims reported a collective loss of over $1 billion to crypto scams, with a median loss of $2,600 per person. Subsequent FBI reports showed that these figures nearly quadrupled by 2023.

In 2023, approximately 80% of Americans targeted in crypto and investment scams lost a median of $3,800. But many victims lost considerably more. When including the most extreme cases, the average losses surpass $100k per victim in many states.

Source: Surfshark In fact, according to 2022 figures, South Dakota had an average loss of $998k per victim, the highest in the US. New Hampshire, Georgia, and Delaware were also in the top 5, with average losses of over $120k per victim.

How Do Crypto Scams Work?

Scammers use various intricate methods to steal your money. But in essence, crypto scams work in two ways – the scammer tries to convince you to send out your crypto, or they’ll try to steal your crypto wallet information to access the money directly.

It’s worth learning about the most common strategies to easily identify threats and keep your money safe. Here are some of the most common crypto scams to be aware of:

Pump and Dump Schemes

Pump-and-dump schemes are common in new crypto projects. The scammer hypes a new crypto token or coin, often through aggressive social media marketing campaigns. The goal is to attract as many investors as possible and bump up the token price.

After enough investors buy said coin, the scammer sells their massive coin supply to cash in at the highest price. This leads to a rapid crash in the token’s value, usually within minutes. In the end, the investors lose money and are left with largely useless tokens.

However, not all cryptocurrencies with large potential returns are scams. The volatility of some cryptos can be due to organic factors like ongoing project developments generating more interest, shifting market sentiment, and even crypto whale activity.

Rug Pull Scams

Rug pulls are the most common crypto investment scam.Similar to pump-and-dump schemes, rug pulls start with a new and hyped-up crypto project that promises massive returns. After attracting investors and raising money, the project suddenly shuts down, and the scammer disappears with the raised funds.

Source: CoinDesk Rug pulls are especially common in DeFi projects thanks to the customizability of blockchain smart contracts. Scammers can program smart contracts to gain direct access to investors’ funds or to limit investors’ ability to sell their tokens.

This was the case for crypto platforms like Thodex and FTX. Rug pulls can also happen with NFT and crypto gaming projects. Just in 2024, the United States Attorney’s Office charged three people in connection to the Evolved Apes NFT scam.

Giveaway and ICO Scams

Giveaway and initial coin offering (ICO) scams both involve exchanging cryptocurrency for supposed massive returns. These scams often involve impersonation and phishing.

In the case of giveaways, the scammers promise the chance of winning a large amount of cryptocurrency, luxury items, and other valuable goods ‘for free.’

The fake websites and social media accounts typically impersonate known personalities and authoritative sources in the crypto space to gain the victims’ trust.

The counterfeit website then asks users to ‘verify’ their wallet address for the giveaway by sending crypto to the scammers. The fake website might also ask for the victim’s private information.

Source: Akamai Similarly, ICO scams either promise giving away free coins, or letting investors buy a new token at a marked discount.

ICO scams trick victims into buying fake or artificially priced coins or sharing their private information. Scammers might also create fraudulent exchanges to launch their ICO and sell their tokens for other cryptocurrencies like BTC.

It’s worth mentioning that not all ICOs are fake. Initial offerings are actually a common way for crypto start-ups to raise money and attract investors, making it difficult to distinguish between fraudulent and legitimate project ICOs.

Romance Scams

Romance scams involve the scammer faking their online identity and pretending to become the victim’s lover. This type of scam can take weeks or even months to set up as the scammer tries to earn the victim’s love and trust.

Then, the scammers start asking for direct crypto payments, or they lure the victim into making crypto investments ‘together.’ In the case of a large investment scam, the scammer vanishes soon after pocketing the victim’s crypto.

Blackmail Scams

Blackmail scams involve a victim receiving threatening emails or messages. They typically contain vague claims that the scammer has compromising information about the victim, such as personal videos, photos, or internet activity.

The scammer threatens to leak the information unless the victim pays them a crypto transfer or hands over their private keys. Victims might be more likely to become targets if their email and other personal information get phished or leaked.

Fake Job Scams

In this type of scam, the scammer creates fake job listings or contacts the victim directly about a remote job offer. The scam typically kicks off by asking the victim to make a crypto payment to ‘begin their training’ or ‘start a deposit’ where they’re supposed to get paid.

Scammers might reach out to people with online resumes, though they might also contact victims directly on messaging apps like WhatsApp. These fake jobs seem highly lucrative and easy to do, and the recruitment process is quick and has no interview process.

How to Protect Yourself From Crypto Scams

Crypto scams are becoming increasingly refined and complex as more people are getting familiar with online fraud tactics. Here are a few key tips to protect yourself from these emerging threats and identify legitimate crypto investment opportunities:

- Remember the basic signs: If something sounds too good to be true, it’s almost guaranteed a scam. Beware of promises of substantial guaranteed returns, especially if a project markets its limited-time offers and heavy bonuses.

- Do your research: Online ads and social media marketing should be taken with a grain of salt. You should always learn more about a crypto project founder and the project’s whitepaper and check for additional information from authoritative sources.

- Ignore random emails and messages: If somebody contacts you out of the blue with a very promising investment or job opportunity, it’s likely a scam.

- Protect your crypto wallet: Security keys give you control over a crypto wallet, so keep them private. Never share them with anyone, and beware of websites or apps asking for this information. Consider a cold crypto wallet for top-notch security.

- Beware of fake websites and apps: Fake websites impersonating reputable ones will have slightly misspelled URLs or use different domain extensions. Only download crypto apps from reputable platforms like Google Play or the iOS app store.

We also recommend looking up a crypto project or platform on the official DFPI website. Although it takes a while for emerging scams to be reported, you might find some recent reports.

If you think you’ve been the victim of crypto fraud, you can also help others by being the first person to send a complaint.

Concluding Thoughts

While the rapid rise of cryptocurrencies has revolutionized finance, it has also attracted a slew of fraudulent schemes that have swindled billions from unsuspecting investors.

The high-profile fraud cases of FTX, OneCoin, and BitConnect prove the growing importance of due diligence in the crypto space. Despite recent declines in global scam revenues, targeted fraud remains a significant threat, particularly in the US.

By understanding common scam tactics and maintaining a healthy dose of skepticism, investors can better protect their assets and choose legitimate investment opportunities.

Remember– despite the allure of guaranteed exponential returns, if it sounds too good to be true, it probably is.

References

Click to expand and view sources- MCC International Corp. (dba “Mining Capital Coin Corp.”, et al. (SEC)

- Mining Capital Coin CEO indicted for allegedly running a cryptocurrency pyramid scheme (CNN Business)

- CEO of Mining Capital Coin Indicted in $62 Million Cryptocurrency Fraud Scheme (DOJ)

- Securities and Exchange Commission v. Luiz Capuci, Jr., No. 23-11139 (11th Cir. 2024) (Justia)

- Alleged Crypto Scheme Operator Loses Appeal Over Asset Freeze (Bloomberg Law)

- EmpiresX Head Trader Pleads Guilty to Global Cryptocurrency Investment Fraud Scheme that Amassed Approximately $100 Million from Investors (DOJ)

- Empires Consulting Corp., et al. (SEC)

- Joshua David Nicholas, et al. (SEC)

- Federal Court Orders Unregistered Florida Commodity Pool Operator to Pay Over $64 Million in Monetary Sanctions for Fraudulent Scheme (CFTC)

- What is Decentralized Finance (DeFi)? (AWS)

- Forsage Founders Indicted in $340M DeFi Crypto Scheme (DOJ)

- United States v. Vladimir Okhotnikov et al (DOJ)

- Two Estonian Citizens Arrested in $575 Million Cryptocurrency Fraud and Money Laundering Scheme (DOJ)

- Seeking Victims in the HashFlare Investigation (FBI)

- Romanian programmer admits that he helped create Bitclub network, a fraud scheme worth at least $722 million (IRS)

- Bitclub – District of New Jersey (USAO)

- Nevada Man Admits Money Laundering and Tax Offenses Related to BitClub Network Fraud Scheme (USAO)

- BitClub Network Victim Questionnaire (USAO)

- Three individuals charged for roles in 1.89 billion dollar cryptocurrency fraud scheme (IRS)

- Three Individuals Charged In $1.89 Billion Cryptocurrency Fraud Scheme (USAO)

- BitConnect Carlos (Know Your Meme)

- How BitConnect pulled the biggest exit scheme in cryptocurrency (TNW)

- BitConnect Founder Indicted in Global $2.4 Billion Cryptocurrency Scheme (DOJ)

- Crypto Lending Site’s Shutdown Renews Ponzi Scheme Claims (Bloomberg)

- Historical Snapshot – 22 October 2017 (CoinMarketCap)

- Digital Era Digital Risks: The Case Study of Turkish Crypto Currencies Market (IBN)

- Thodex Founder Faruk Fatih Özer Sentenced to 11,196 Months and 15 Days in Prison (BitcoinSistemi)

- Turkish crypto exchange boss goes missing, reportedly taking $2 billion of investors’ funds with him (CNBC)

- Founder of crypto exchange that went bust gets 11,000-year prison term in fraud case (Fortune Crypto)

- The $2 Billion Heist: Inside the Thodex Crypto ExchangeScandal (CoinMarketCap)

- Co-Founder Of Multibillion-Dollar Cryptocurrency Scheme “OneCoin” Sentenced To 20 Years In Prison (USAO)

- FBI Most Wanted Fugitive Ruja Ignatova (FBI)

- ‘Cryptoqueen’ Ruja Ignatova, mastermind of the OneCoin scam, was still investing in Dubai while under indictment (Le Monde)

- Samuel Bankman-Fried Sentenced to 25 Years for His Orchestration of Multiple Fraudulent Schemes (DOJ)

- FTX crypto ‘king’ Bankman-Fried guilty of ‘one of the biggest financial frauds in American history’ (Euronews)

- Bankman-Fried used $100 mln in stolen FTX funds for political donations, US says (Reuters)

- 2024 Crypto Crime Trends: Illicit Activity Down as Scamming and Stolen Funds Fall, But Ransomware and Darknet Markets See Growth (Chainalysis)

- The Biggest Threat to Trust in Cryptocurrency: Rug Pulls Put 2021 Cryptocurrency Scam Revenue Close to All-time Highs (Chainalysis)

- Federal Bureau of Investigation Internet Crime Report 2022 (IC3)

- Crypto scams are robbing Americans blind (KTLA5)

- Financial losses through cryptocurrency fraud among individuals over 60 years in the United States from 2020 to 2022 (Statista)

- Monetary losses of cybercrime victims among individuals over 60 years in the United States in 2022, by type of crime (Statista)

- Reported crypto scam losses since 2021 top $1 billion, says FTC Data Spotlight (FTC)

- Reports show scammers cashing in on crypto craze (FTC)

- Cryptocurrency fraud is now the riskiest scam for consumers, according to BBB (CBS News)

- Average losses of crypto scams in the US (Surfshark)

- U.S. Charges Three in Connection With Evolved Apes NFT Scam (CoinDesk)

- Crypto Scam Tracker (DFPI)

Our Editorial Process

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.Diana Ploscaru Statistics & Tech Content Contributor

View all posts by Diana PloscaruDiana is a seasoned writer with over four years of freelancing experience. Using her keen interest in statistics and data analysis, she specializes in crafting informative and practical content across various interesting topics.

She's also passionate about workflow optimization, constantly researching and trying out the newest tools and project management software. Because it's always exciting to find new ways to streamline daily tasks!

In her free time, she enjoys studying foreign languages and going for hour-long walks to reach her daily step goal.

Latest News

Elon Musk to Move X and SpaceX Headquarters from California to Texas

On Tuesday (July 16), Elon Musk announced that he’s moving the headquarters of his companies X and SpaceX from California to Texas. While SpaceX is moving to Starbase (a company...

AI Startup Anthropic and Menlo Ventures Join Hands to Launch a $100 Million Startup Fund

AI startup Anthropic and its biggest investor Menlo Ventures are launching a $100 million startup fund that will be used to back new startups. Menlo will supply the cash to invest...

REGULATION & HIGH RISK INVESTMENT WARNING: Trading Forex, CFDs and Cryptocurrencies is highly speculative, carries a level of risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. Please note that we do receive advertising fees for directing users to open an account with the brokers/advertisers and/or for driving traffic to the advertiser website.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© Copyright 2024 The Tech Report Inc. All Rights Reserved.

Scroll Up

Question & Answers (0)