CBDC Meaning – Will It Replace Cash and Should You Worry?

To explain the meaning of CBDCs (central bank digital currency), they’re a digital currency issued by a central bank. As an example, imagine the US was founded in 2024, and the founding fathers used Bitcoin as the official currency instead of the NUSD (New American Dollar or what have you).

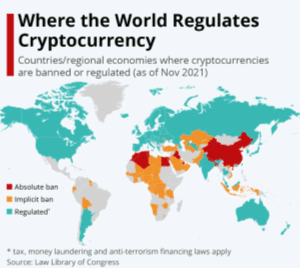

Around 98% of the global GDP (134 countries & currency unions) are exploring CBDCs because cash usage has declined by ~33% in Europe between 2014 and 2021.

For instance, Norway’s Norges Bank’s latest survey shows that only 3% of payments were cash, as most Nordics prefer card payments.

So far, central governments haven’t outright stated they want to eliminate cash, but that remains to be seen.

What Is CBDC and How Does It Work?

And with the Deutsche Bank’s renewed interest in the Digital Euro, CBDCs might be closer than we think. A US digital currency (like a Fed coin) was under public debate at one point, but many financial experts are on the fence about the risks of CBDCs.

The Advantages and Downsides of CBDCs

Here are the theoretical use cases and benefits of CBDCs:

While the apparent benefits of CBDCs are significant to an ever-growing cashless society, it doesn’t come without downsides:

| Downsides | Details |

| 🔎 More financial centralization | Central banks will have absolute control over the issuance of CBDCs, which potentially means they could add or remove money from any account at any time. |

| ⚖️ Insufficient utility | – The Bank of Canada stated in 2021 that they don’t see a use case for CBDCs, and Denmark’s National bank has made a similar claim. – Denmark has one of the most digitized financial systems in the world, but it still doesn’t see a purpose for a digital kroner. – The Cato Institute’s 2023 article summed up the risks of CBDCs and what financial experts and analysts think. |

| 🧿 Less privacy | Governments will have an eagle-eye view of everyone’s spending, purchases, and financial transactions. Tracing money would be easier, and the surveillance potential would grow considerably. A unified CBDC database of citizen data would also become an attractive target for cyberattacks. |

| 🔐 Data protection issues | CBDCs could exacerbate existing data privacy issues regarding digital payments. If the underlying infrastructure of CBDCs isn’t carefully designed, third parties may unlawfully use transactional data for credit evaluation of individuals. They could also sell your data to ad companies. |

| 💣 Government manipulation | Depending on the implementation, CBDCs could allow governments to control or, at the very least, influence: – Citizens’ behavior in society by controlling their digital currency wallets. This allows governments to encourage desirable behaviors and discourage undesirable ones, similar to China’s social credit system, where citizens are assigned a credit score indicative of their trustworthiness. Bad scores often lead to penalties like travel bans and career obstacles. – Individual freedom, making it impossible for you to send money to a dissident NGO or activist movement or purchase prohibited products, for instance. – The ‘expiration date’ of the digital currency, forcing you to buy things you don’t need, driving consumer consumption. |

| 🛠️ Technological instability | The CBDC wallets or underlying infrastructure might have technical issues that make people unable to access their funds. The Eastern Caribbean DCash was offline for two months due to technical glitches. |

Types of CBDCs

There are two types of central bank digital currencies:

1. Retail CBDCs

These digital currencies are used by the general public (individuals and businesses) and act as digital money for regular spending (like online purchases and in-store payments). They are also a digital representation of the country’s fiat currency.

Only Nigeria, The Bahamas, and Jamaica have launched retail CBDCs so far, and the data doesn’t bode well for them:

With such low adoption rates, the CBDC vs cash dilemma seems far-fetched, but this isn’t stopping governments from trying.

2. Wholesale CBDCs

Wholesale CBDCs are used for interbank payments, securities transactions, and other financial operations between licensed financial institutions.

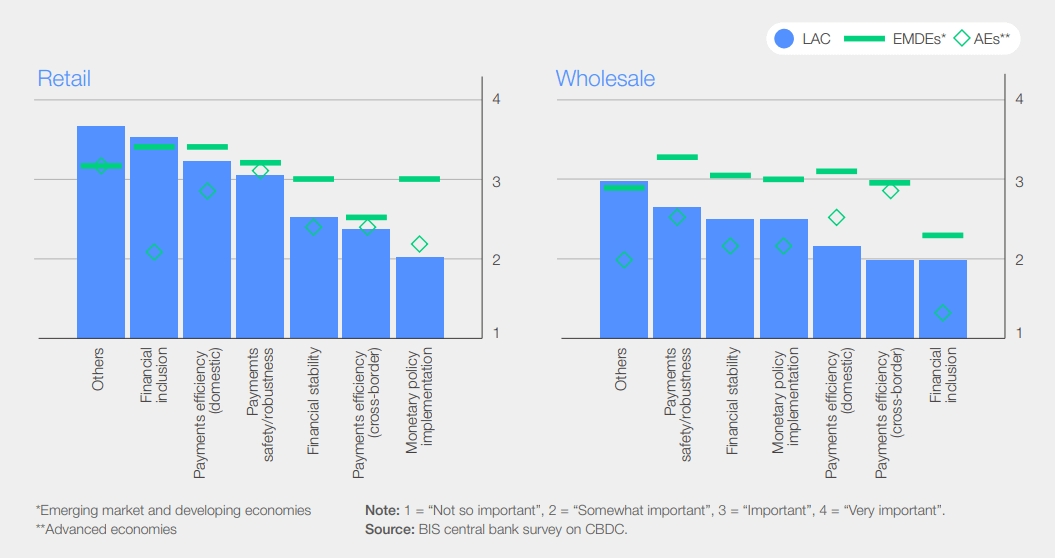

According to the World Economic Forum, payment safety and robustness are the biggest reasons why countries in Latin America are considering CBDCs.

Wholesale CBDCs aren’t as disruptive as retail CBDCs because financial institutions already use a similar system in the reserve accounts of commercial banks with central banks.

Currently, wholesale CBDCs are in the pilot phase in 19 countries, being developed in 17, researched in four, and one country (Venezuela) hasn’t posted any updates since 2021.

CBDC vs Cash vs Traditional Digital Banking

With CBDCs explained, let’s see how they compare to cash and traditional digital banking.

Cash is by default private and anonymous, and unless you leave a paper trail, no one can track your financial activities. That’s why cash remains the preferred money laundering method for criminals.

Cash is physical, and unless someone’s following you 24/7, it’s next to impossible to determine what you buy with cash.

The central bank is the absolute authority that controls CBDCs, from issuance to governance, use cases, and day-to-day activities. It’s in the CBDC definition.

By default, the central bank will know:

This could become the biggest deliberate data leak in history, with the government possessing unprecedented knowledge and control over your financial life.

This control may, in theory, allow the government to automatically tax specific transactions (like the cryptocarbon corrective tax), block undesirable purchases, empty out bank accounts, and move money around liberally.

With regular digital banking, the government can’t access your financial history by default, control your money flow, or tax specific transactions. They must liaise with your bank and provide legal justification to access your records or block your money.

Digital banking is more easily traceable than cash but significantly less so than CBDCs.

More importantly, we already have instant or near-instant transactions, which is among the chief benefits touted by CBDCs. The US’s FedNow program also aims to bring real-time payments to all banks.

Do Cashless Societies Automatically Lead to CBDCs?

A fundamental reason for most governments researching and implementing CBDCs is the decrease in cash usage.

But that doesn’t necessarily imply a transition to CBDCs. Denmark and Norway are living proof of mostly cashless societies that don’t find retail CBDCs worthwhile.

Norway’s entire population has a bank account and 97% of payments are digital. Still, in December 2023, the Norges Bank claimed that a retail CBDC is currently unnecessary.

When it comes to Denmark, over 80% of payments are digital. But they don’t see a worthwhile use case for a retail CBDC either.

Given that two of the countries closest to becoming cashless don’t see the merits of retail CBDCs, it’s worth wondering whether we need CBDCs at all.

Are CBDCs Good for Us, and Will They Replace Cash?

Here’s what we know with all the data gathered so far:

So far, we’ve seen no indication that CBDCs will replace cash but it’s not for a lack of trying from governments.

FAQs

Will CBDC replace cash?

What is the purpose of a CBDC?

Is the US going to a digital dollar?

Is CBDC a good idea?

References

Our Editorial Process