The Best Payroll Software for the UK | Top 3 Reviewed and Compared for 2024

With the best payroll software in the UK, you can get your payroll process down to a matter of minutes instead of manually sorting this vital aspect of your business and spending hours of precious time away from running other parts of your company. Payroll software will help you automate every step of the payroll process.

With the right payroll solution, you can easily manage employee payments, approve timesheets, keep accurate records and sort out taxes. To help you choose the best UK payroll software for your business, we’ve tested and reviewed three top payroll software providers on the market in 2024. Read on to find out more.

Best UK Payroll Software in 2024 | Top 3 Shortlist

- Xero — Best Payroll Software in the UK

- QuickBooks — Best Payroll Software For Small Business UK

- Sage — The Most Popular Payroll Software Amongst Accountants in the UK

The Top 3 UK Payroll Software Providers | Reviewed

1. Xero – The Best Payroll Software in the UK

Xero’s payroll software is available as an add-on to their accounting software, so it’s important to keep this in mind when considering Xero for your payroll needs. The good news is that any new customer can get Xero’s payroll module free for three months with every Xero plan, alongside enjoying a free trial for 30 days of any Xero plan. With these options, you can try Xero’s payroll software for free to see if it’s right for your business.

The payroll software itself has a few features we particularly like. First, you can try the software for free to see if it suits your needs. If you decide the payroll solution isn’t right for you but still enjoy Xero’s accounting suite, you can easily downgrade so your plan doesn’t include payroll. But if you do like Xero’s payroll module, then you can use it for free for three months, after that the payroll module is relatively affordable, priced at just £5 a month for up to five users and an extra £1 a month for each additional member beyond this.

This flexibility offered by Xero is quite unique among the solutions we tested and could be very useful if you’re a growing business and know you’ll need additional users to use the platform as your business grows.

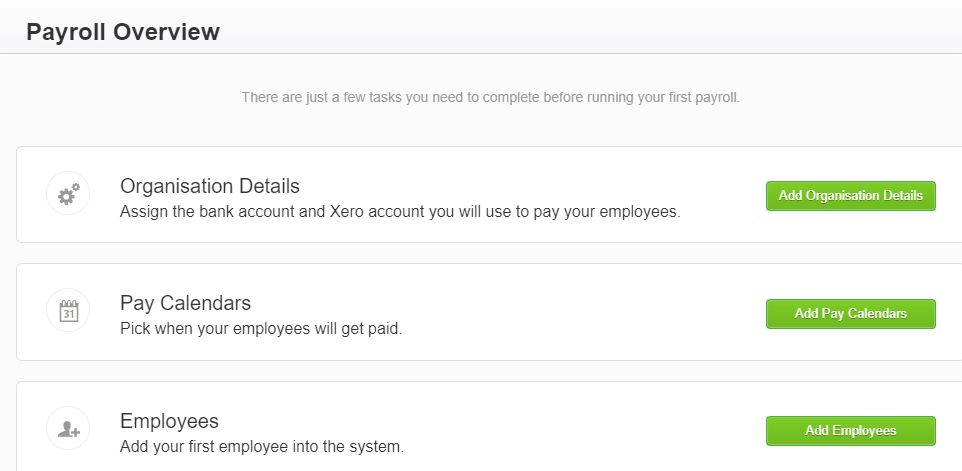

The platform also offers the features you need to ensure your payroll operations are running smoothly. On the ‘Overview’ dashboard, you can add your organisation details, choose your pay cycles to pick when your employees get paid and easily add new employee details into the system. If you have to adjust your pay run, the system will automatically work out tax and leave calculations and process these adjustments for you.

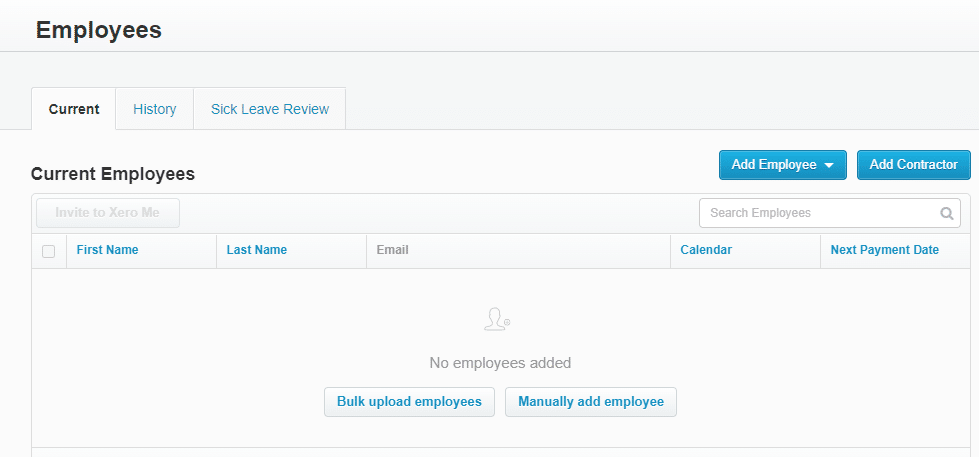

On the ‘Employees’ dashboard, you can manually add a new employee to your system or bulk upload a number of employees. You can also add any contractors you use, making it easy to pay your own staff and contractors from the same platform.

On the ‘Leave’ dashboard, you can approve or deny employee leave requests, schedule leave, edit existing requests and see who’s away on any particular day. While on the ‘Timesheets’, ‘Pay employees’ and ‘Taxes & filing’ screens, you can approve, deny or edit employee timesheets, manage pay runs and make tax adjustments. We like how each section has its own dashboard; this makes for a positive user experience and makes it easy to find the information you need.

Overall, we were impressed with Xero’s payroll software. It’s easy to navigate, has all the payroll features a small business would need, and its flexible pricing and add-on options make it our top payroll choice for UK businesses.

| Starting Price | Compatibility | Users for Starting Price | Free Trial/Plan | Money-Back Guarantee |

| £14/month | Windows, Mac, iOS, and Android | Unlimited | 30-day free trial | 45-day money-back guarantee |

Pros

- The platform is easy to navigate, with different features laid out in a clear way

- Flexible pricing

- Ability to add new users at a low price

- HMRC Recognised

Cons

- To use the payroll software, you need to sign up for Xero’s accounting software, which may not be useful for some customers

Pricing

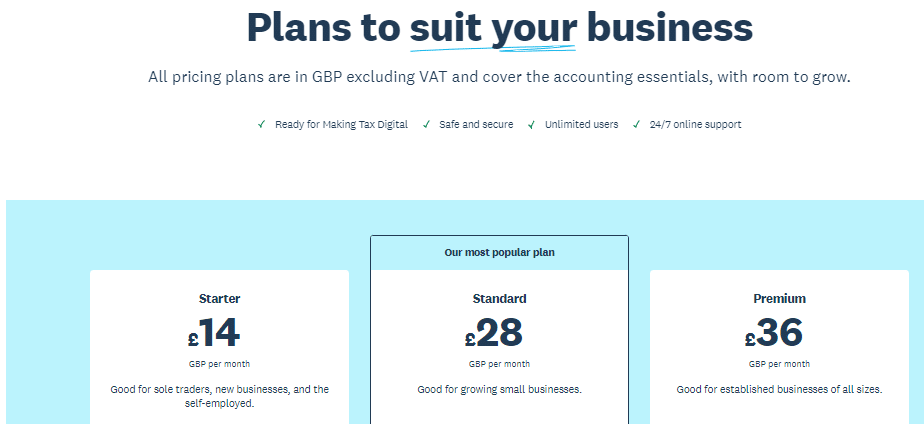

Xero has four plans available:

- The first plan is for sole traders and new businesses and costs £14 a month plus VAT

- The most popular mid-tier plan is suited to small businesses and costs £28 per month plus VAT

- The Premium plan costs £36 per month and is a good plan for established companies of all sizes

- The final plan, named ‘Ultimate’, costs £49 a month and is suited to larger businesses with more complex needs.

Xero also offers a 30-day free trial which contains all of the features from all of their plans so you can truly test out the platform before deciding which plan is right for you.

2. QuickBooks – The UK’s Most Easy to use Payroll Software

QuickBooks accounting software is one of the market’s most recognizable accounting, bookkeeping and payroll solutions. If you’re looking to use QuickBooks for payroll, you’ll need to purchase a QuickBooks plan with a QuickBooks payroll module added to it if you’re a new customer.

If you’re an existing QuickBooks customer, you’ll be pleased to hear that the QuickBooks payroll modules integrate seamlessly with the platform. We recommend contacting QuickBooks for information on adding payroll features to your existing plan.

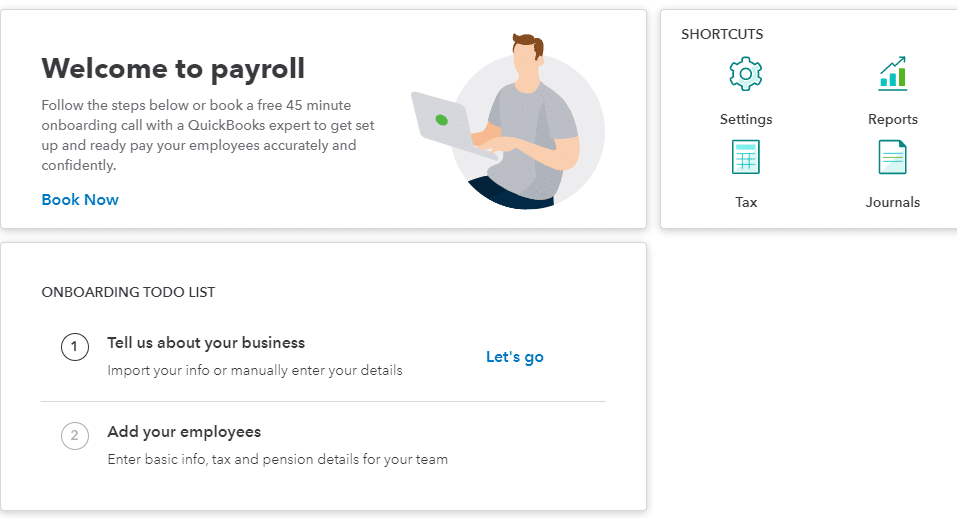

If you’re a new customer, you can access QuickBooks accounting and payroll software through the QuickBooks website by choosing from five separate plans. Once you’ve selected your plan, you’ll need to add some information about your business to access the payroll features on the platform.

QuickBooks offer a free 45-minute onboarding call if you need help getting set up. We really like that QuickBooks offers this, as it’s common for accounting and payroll software providers to only offer limited customer support.

After you’ve added your company information, you can add employee details and any relevant pay history information to the platform.

Once you’re happy with your setup, you can start enjoying the payroll features QuickBooks offers. Such as automatically generating payslips for employees, sorting PAYE and national insurance calculations, calculating employee maternity, paternity and sick pay, managing timesheets and rotas and setting up automatic pension contributions for your employees.

The payroll features that you require from QuickBooks will depend on the size of your business and your requirements, but overall the payroll options QuickBooks offer are impressive.

With a selection of plans to choose from, you should have no problem finding a plan to fit your payroll needs and if you’re an existing QuickBooks customer, any payroll add-on that your purchase will fit seamlessly into your current system.

| Starting Price | Compatibility | Users for Starting Price | Free Trial/Plan | Money-Back Guarantee |

| £0 per month for three months, then £8 per month. | Windows, Mac, iOS, and Android | 1 | 30-day free trial | Custom |

Pros

- Payroll features are easy to use

- An onboarding call offered to help you customise your setup

- A variety of plans to choose from

- HMRC Recognised

Cons

- QuickBooks payroll software is the only payroll software the company supports, so you are limited in choice if you’re a current QuickBooks accounting customer with payroll needs

Pricing

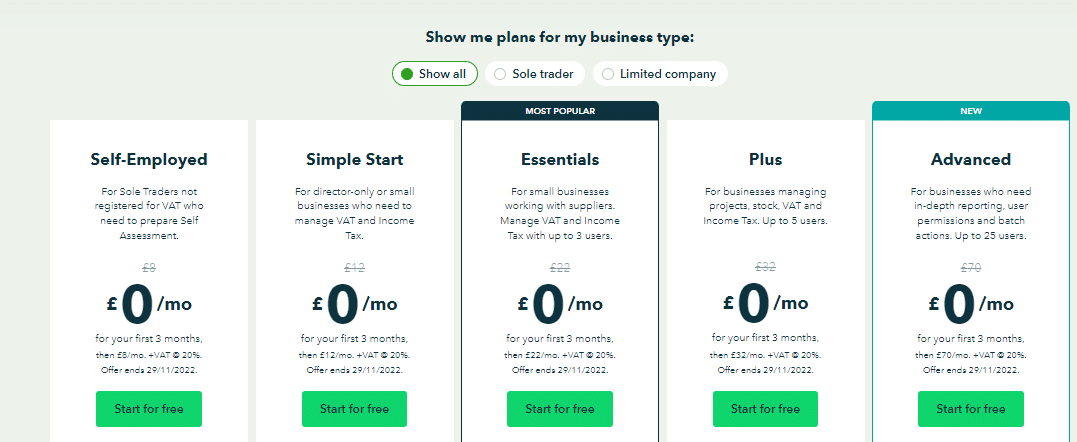

QuickBooks offers UK customers five different plans, which include payroll solutions. At the time of writing, customers can enjoy three free months of service with any plan.

- The first plan is designed for self-employed individuals, not registered or VAT, who need to prepare their self-assessment – this plan includes help for self-assessment preparation and income tax estimates. You can use the plan for free for three months before paying £8 a month.

- The second plan is for director-only or small businesses that need to manage VAT and income tax, and after three free months of service, the plan costs £12 a month.

- The third plan is for small businesses with suppliers who need to manage VAT and Income Tax; this plan is free for the first three months and costs £22 a month afterwards.

- The fourth plan is suitable for businesses managing projects, stocks, VAT, and Income Tax. After three free months, this plan will cost you £32 a month.

- The fifth and final plan is for businesses with more advanced needs who require in-depth reporting, different user permissions and batch actions, and after three free months, this plan costs £70 a month.

3. Sage – The Most Popular Payroll Software Amongst Accountants in the UK

Sage is a household name in the UK payroll software market, with HMRC officially recognizing the company. Sage’s payroll solution offers UK customers a payroll solution that is cost-effective and packed full of valuable features.

The service allows you to manage payroll for up to 100 employees, efficiently complete a pay run, enable employees self-serve payslips and P60s and report and analyse your payroll.

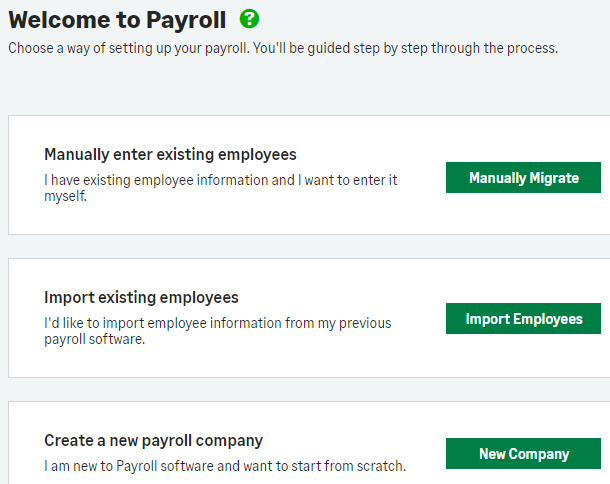

When you jump into Sage Payroll, you can manually enter employee details, import employees from previous payroll software or create a new payroll company from scratch. We like that you can import employee details from existing software; this process can save you a considerable amount of time during setup if you’ve used payroll software before.

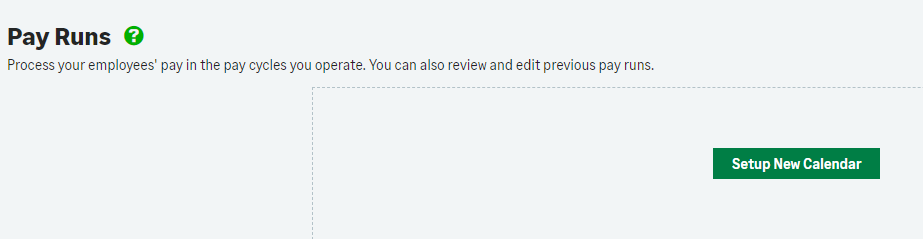

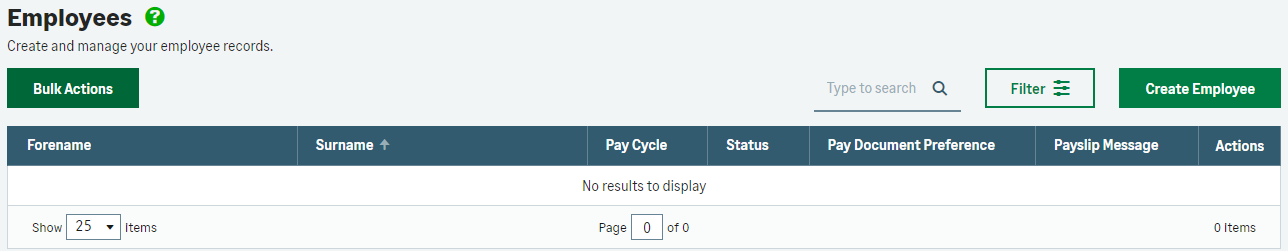

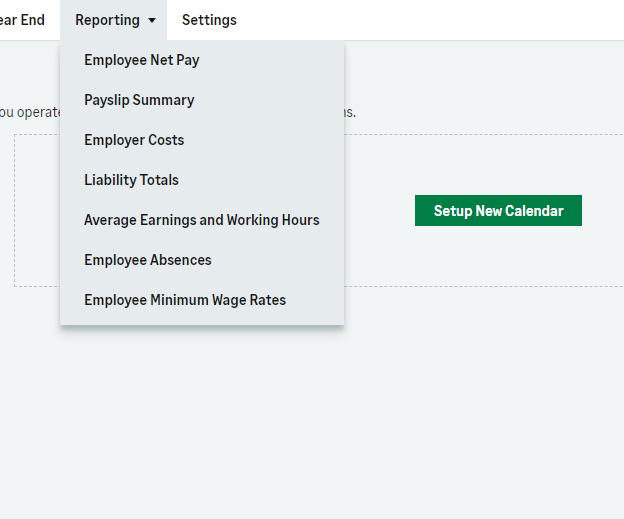

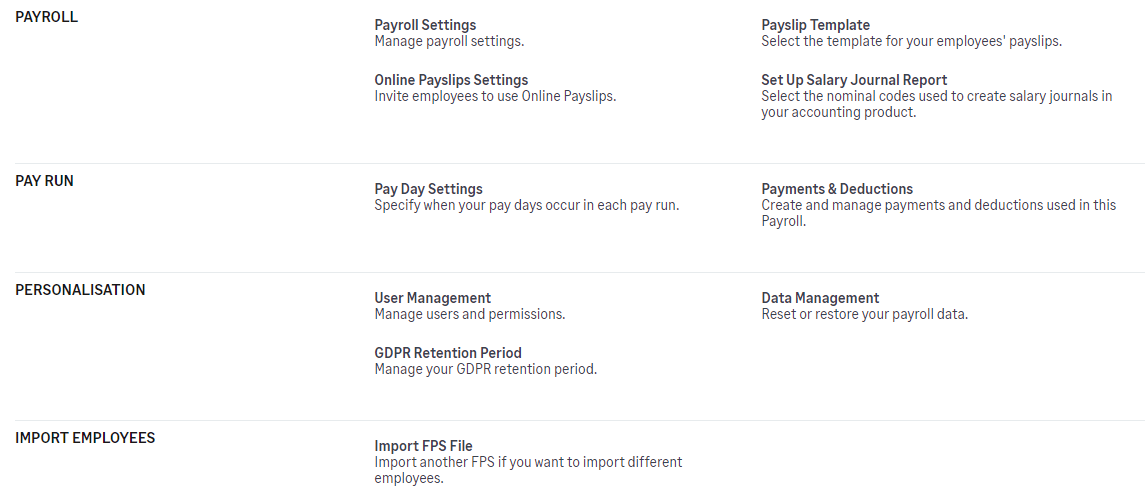

Inside the platform, you can also use the top navigation bar to go to the Pay Run, Employees, Year End and Reporting screens. On the Pay Run screen, you can process your employee’s pay in the pay timeframes that you operate; on the Employees section, you can create and edit employee records and, on the Reporting screen, navigate through different reporting options. On the Settings screen, you can adjust individual settings for the features that you are using.

The platform is extremely easy to navigate around and get used to. While it may not look as sleek as other SaaS solutions, Sage has done a great job not overcomplicating its payroll software, and even if this is your first time using payroll software, the learning curve should be manageable.

Sage Payroll also integrates with Sage’s accounting software and their HR solutions so you can manage your entire payroll, HR and accounting needs through Sage. However, one limitation of the platform is that it will only allow you to manage payroll for up to 100 employees. If you’re running a small business, this is fine, but if you have more than 100 employees, you’ll need to look at a different payroll provider.

| Starting Price | Compatibility | Users for Starting Price | Free Trial/Plan | Money-Back Guarantee |

| £0 for six months, then £7.00 per month | Windows, Mac, iOS, and Android | 1 | 6 months free on any plan | 6-month money-back guarantee |

Pros

- HMRC Recognised

- Easy-to-use platform

- Easy to switch to Sage from your current payroll software provider

- A good amount of reporting options

Cons

- Not the most stylish of platforms

- Not suitable for businesses with more than 100 employees

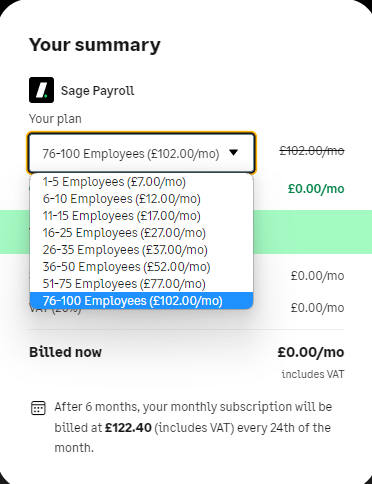

Pricing

Sage’s pricing structure is very clear. At the time of writing, Sage offers six free months of its payroll software. After six months, the service’s price will depend on the number of employees your business employs. Prices range from £7 a month (after six free months) plus VAT if you have 1-5 employees to £102 a month plus VAT after the free six-month period for businesses with 76-100 employees.

See a breakdown of the pricing in the image below:

The Best UK Payroll Management Solutions | Compared

| Payroll Software | Starting Price | Users For Starting Price | Free Trial | Money-Back Guarantee |

| Xero | £14/month | Unlimited | 30 Days | 45 Days |

| QuickBooks | £0 per month for three months, then £8 per month. | 1 | 30 Days | Custom |

| Sage | £0 for six months, then £7.00 per month | 6 months free on any plan | 30 days | 6 months |

Why Do I Need a Payroll Tool for My Business?

There are many reasons you may want to look at implementing payroll software for your business. Here are some of them:

You Want to Save Time

Payroll software/tools can help you save time by automating payroll tasks. For example, processes such as income tax deductions and National Insurance Contributions will all be worked out automatically. Payroll software can also track processes such as employee absences, holiday pay, bonuses, salaries and pensions. If you’ve been managing these things manually, you’ll know they can be time-consuming, and when they are automated, you’ll have more time to spend on other parts of your business.

You Want to Improve Accuracy and Simplify Your Payroll Process

Like with any manual data entry process managing your payroll manually opens your business up to the risk of human error and costly mistakes. When your payroll processes are automated, the risk of human error is removed, and the accuracy of your payroll processes improves.

You Want Your Employees To Benefit

Many payroll software services have employee self service portals where employees can view their payslips, book time off and check and update their personal details. This level of access can help build trust between yourself and your employees and gives them greater autonomy.

You Want To Stay Compliant

Payroll providers such as QuickBooks automatically track the latest tax regulations, so you won’t have to worry about your business failing to comply with HMRC through missing a tax regulation change. Payroll software will also typically keep abreast of any changes to things that could affect payroll, such as GDPR and pension changes.

Factors to Consider When Choosing the Best UK Payroll Software for Your Business

There’s a lot to take into account when considering a payroll software. Let’s have a look at the most common reasons:

Your company’s requirements

Number of employees

The number of employees you have will determine the payroll provider you go with. Keep in mind how many employees you currently have on your payroll, their requirements and whether you expect this number to grow. The more employees you have, the more robust the payroll software you use will need to be.

Is your business growing?

Business growth typically means employee growth, which means the payroll software you choose should ideally be able to scale with you as your business grows. Look for a solution that can support your current needs but also support your requirements as they change.

Employee types

You may have numerous employee types in your business, from full and part-time staff to contractors. If you have different employee types working for you, look for a payroll system with bulk processing available, as this will make it easier to ensure all of your employees successfully make it onto your payroll without requiring you to upload each employee’s details manually.

Your budget

Each payroll provider will have different payment models and plans available. Ask whether there will be any additional costs for particular features you’re after, including support, to ensure your quotes are accurate. You can also get a special deal if you are already with a payroll software provider for other services, such as accounting, but need to add a payroll module to your current plan.

Software Requirements

Ease of use

The payroll software you use should have a good balance between ease of use and functionality. All of the platforms we tested in this review were straightforward to use, particularly Xero and QuickBooks. Also, keep in mind who will be using the platform and their level of technical expertise.

Cloud-based or on-premise

Most payroll and accounting software solutions are now cloud-based, meaning the software is accessed through a web browser. It’s an important consideration to make whether you want your solution to be cloud-based or on-premise (installed on a server at your business’s physical location).

Cloud-based solutions are becoming increasingly popular for companies due to their speed, convenience and security. Cloud-based software also works best for companies operating remotely or with employees in different locations.

Integrations

It’s worth investigating what apps and other software a payroll provider can integrate with. For example, you may already be using accounting software or an HR platform that may integrate with the payroll solutions you’re considering.

Other things to consider

Does the provider offer a free trial?

If you’d like to try a payroll solution before you commit to purchasing it then keep an eye out for whether the provider offers a free trial.

What level of support does the provider offer?

It’s important to keep in mind the level of support a provider offers and how much support you think you’ll need. Usually, the level of support you receive will depend on the level of plan that you’re on.

For example, QuickBooks only offer free chat messaging support to customers on their Self-Employment plan, while they offer free onboarding sessions for users and phone support to customers on their Advanced package.

Conclusion | What’s the Best Payroll Software in the UK in 2024?

This guide should have given you some good insights into the different payroll software solutions available in the UK. We tested each provider thoroughly, considering each provider’s price, the plans they offer, their features and more.

Xero was our choice for the best payroll software in the UK due to the flexibility the company provides. You can try out Xero for free to see if it’s the right payroll solution for your business. Plus, as we mentioned in our review of Xero, you can easily upgrade your platform to include their payroll solution if you already use Xero’s accounting software.