Best Self-Employment Accounting Software | Top 7 Reviewed in 2024

The best self-employment accounting software lets you manage your business’s financial and accounting activities and generate detailed cash flow and financial reports that allow you to make better financial decisions. With the best self-employed accounting software, you can reap the benefits of streamlining various business functions, such as client payment reminders, bank reconciliations, invoice creation, and filing tax returns.

However, finding the best self-employment accounting software isn’t easy, given the plethora of options available. Based on criteria such as pricing, integration capabilities, number of invoice templates, automation, and others, we’ve found the best software for self-employed business owners. Read on to learn how experts like Zoho Books, Oracle NetSuite, and QuickBooks can help you catapult your business.

Best Self-Employment Accounting Software | Top 7 Shortlist

Zoho Books tops our list of the best self-employment accounting software. We were blown away by its free forever plan, its approval system, recurring invoices, automatic reminders, banking integrations, ease of payments, and time tracking. With that said, the competition is certainly tough:

- Zoho Books — Overall, the Best Self-Employment Accounting Software in 2024 | Put it to the Test with the Free Forever Plan.

- FreshBooks — Leading Accounting Software for Self-Employed Individuals for Expense Management | Try the 30-Day Trial.

- Patriot — One of the Best Accounting Software for Small Businesses | See For Yourself With a 30-day Free Trial.

- Oracle NetSuite — The Best Self-Employed Accounting Software for Real-time Financial Updates | Get a Custom Quote Now.

- QuickBooks — The Best Small Business Accounting Software with Impeccable Time Tracking | Try it Now with the 30-Day Trial.

- Sage Accounting — Popular Self-Employed Accounting Software for Auto-Categorizing Transactions | Test it Free for a Month.

- Xero — Quality Self-Employment Accounting Software for Monitoring Your Investments | Try the 30-Day Trial Before Committing.

- Bonsai — The Best Self-Employed Accounting Software with In-House Human Expert Assistance | Has a Solid 14-Day Trial and Guarantee.

The Top 7 Self-Employed Accounting Software Solutions | Reviewed

Eager to know more about the top 7 self-employed accounting software? Here, we’ll review their best features, pricing, pros, and cons to give you all the nitty-gritty details you need to find the one best suited to your business.

1. Zoho Books — The Best Overall Self-Employment Accounting Software in 2024

Zoho Books is a feature-rich and powerful accounting software best known for its generous free plan, which makes it the most ideal for small businesses and self-employed professionals.

One of our favorite Zoho Books features is invoice creation. You won’t have to download entirely new software to create separate invoices for each client. Pick a template you like from Zoho Books’ vast collection, customize it, add your branding and you’re ready to roll.

This will not only save you a lot of time, but it’ll also ensure that every single invoice of yours looks professional and reflects your brand’s image.

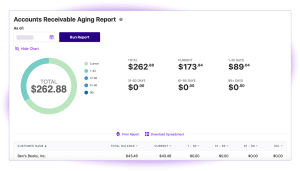

If you’re not comfortable following up on clients who are yet to pay or just don’t have the time to do it, Zoho Books will let you set up automated payment reminders so that you can get paid on time without personally nagging the client.

To improve customer satisfaction, Zoho Books also comes with a dedicated client portal where your customers can check their past transactions, make new payments, leave feedback, accept or reject a quote, and much more.

Basically, it’ll give your clients full control and transparency over the money invested in your company, which in turn, helps you build customer trust and satisfaction.

Need to eliminate the risk of fraudulent payments? Zoho Books not only logs every single payment made from your account but also leaves audit trails.

This way, you’ll be able to see all transaction entries plus the changes made to these entries, preventing corrupt employees from hiding transactions from you.

| Starting Price | Top Features | Free Trial | Customer Support |

| $0 | 1. Invoice creation too

2. Time tracking 3. Automated follow-ups |

14 days | 24×5 email or call |

Pros

- A single platform to track multiple projects

- An excellent 24-hour customer support

- Information-laden dashboards

- A quick and easy configuration

- A useful Android and iOS app

- Features like categorized banking transactions

Cons

- Limited third-party app integrations

- Payroll integration is available only in Texas and California

Pricing

If you’re a small business with a revenue of less than $50k per annum, Zoho Books’ free plan will serve you well.

With the free plan, you can manage up to 1,000 invoices plus enjoy a boatload of other features, including multi-lingual invoicing, expense tracking, and support over email.

For support over voice and chat plus more integrations and invoices, select a higher-end plan. There are 5 paid plans — catering to various needs and budgets.

Plus, besides the free plan, Zoho Books also has a 14-day free trial on all its paid plans, so you can try it in all its glory, completely risk-free.

2. FreshBooks — Leading Accounting Software for Self-employed Individuals for Expense Management

FreshBooks, being beginner-friendly and simple to use, is one of the best accounting tools for self-employed individuals operating without a tech team.

It simplifies managing clients with a dedicated client portal. Here, you can access the payment history, and customer invoices, plus share important project data and proposals. Consider it an all-in-one company-to-customer communication channel.

Better communication isn’t the only thing that FreshBooks’ client portal provides to keep your customers happy. It also boosts transparency and makes your clients feel more in control, which ultimately drives up their satisfaction.

You can either choose FreshBooks’s native payment option — FreshBooks Payments, or stick to PayPal or Stripe.

With FreshBooks Advance Payments, you get a few more benefits, such as recurring billing profiles for regular customers and auto-saving credit card information for certain clients to auto-charge them every month.

Both these features take away the hassle of creating a new invoice every month and manually processing the payment — FreshBooks does it automatically so that you focus on more important things.

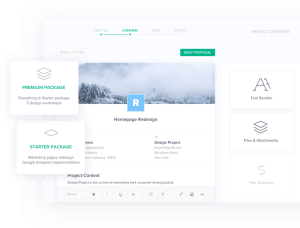

On top of this, FreshBooks’ custom proposal generation tool will help you win over your clients by sending them professional-looking proposals. Each proposal comes with an in-app commenting feature where the client can share their feedback and you can make timely amends — boosting collaboration and transparency among both parties.

| Starting Price | Top Features | Free Trial | Customer Support |

| $6/month | 1. Expense tracker

2. FreshBooks Payments 3. Compatible with major banks |

30 days | Call |

Pros

- A 30-day free trial

- Extensive reporting capabilities

- Comes with double-entry accounting features

- Compatible with various platforms and OS

- Permits integrations with several third-party apps

- Allows customized tax calculation

Cons

- Adding additional members require extra costs

- No quarterly income tax payments reports

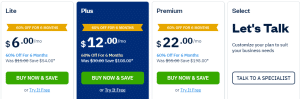

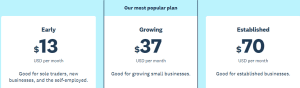

Pricing

For as little as $6/month, FreshBooks’ starter plan will allow you to send unlimited invoices to up to 5 clients, track unlimited expenses, and send unlimited estimates.

While other software allows an accountant on their basic plan — FreshBooks, unfortunately, doesn’t.

To add an accountant and extra features like automatic expense tracking, getting paid with checkout links, and removing FreshBooks’ branding from client emails, get a premium FreshBooks plan, all of which are affordably priced.

Put FreshBooks to the test with the 30-day free trial — no credit card information is needed.

3. Patriot — One of the Best Accounting Software for Small Businesses

Patriot is one of the most affordable accounting software. After the free 30-day trial, you can move to its basic plan, which is loaded with robust accounting features — almost everything you’ll need to manage a small business.

One of our favorite things about Patriot is it lets you add unlimited vendors and users. For the vendors, you can track all their payments in one place so that there are no discrepancies regarding transactions.

Speaking of the user, you can bring your entire team on board for free. Plus, since Patriot lets you create user-based permissions, you can control what each employee can see, limiting their access to anything confidential and outside of their job role.

Patriot also makes it easy to import external data to the dashboard to centralize all your transactions and simplify account closing.

For example, if you want to manage your bank transactions directly from the software, you can connect your bank account and credit card with Patriot; each transaction will be automatically logged in here. Although it does allow you to manage the entries manually in case you want more control, automating it will just save you more time.

Speaking of imports, if you’re already using different accounting software, you can import all your data, including trial balance, transactions, customer & vendor data, and everything else, in just a few clicks — that’s how easy it’s to get started with Patriot.

| Starting Price | Top Features | Free Trial | Customer Support |

| $20/month |

|

30 days | Call, chat and e-mail |

Pros

- Allows adding unlimited users

- You can handle unlimited customers and invoices

- You can also set up user-based permissions

- An intuitive, easy-to-understand dashboard

- Excellent customer support

Cons

- Limited reporting functions

Pricing

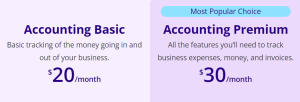

The Patriot “Accounting Basic” plan costs $20 per month and allows users to create and track unlimited customers and invoices, import data easily, have access to free expert support, and bring on an unlimited number of users.

The “Accounting Premium” plan, which is $10 more per month, offers additional features such as user-based payments, account reconciliation, and custom invoice templates.

Both plans offer a 30-day free trial for users to try Patriot risk-free.

4. Oracle NetSuite — The Best Self-employed Accounting Software for Real-time Updates on Profit Margins, Inventory, and more

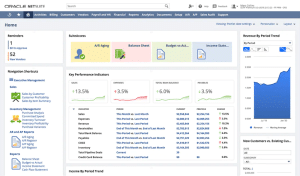

Oracle NetSuite’s accounting solution will give you a comprehensive view of your cash flow and equip you to make smarter financial decisions, making it ideal for self-employed people without a dedicated accounts department.

What we really like about NetSuite is that it gives you real-time updates about a lot of financial metrics. Unlike most other tools where the reports are limited to expenses, profits and revenue, NetSuite also covers:

-

- Profit margin

- Inventory margin

- Taxes

- Liability

- Fixed assets

- Profitability ratio

With a comprehensive understanding of every nook and corner of your business, you’ll be able to make both short and long-term financial decisions to achieve your financial goals.

Plus, to help you get paid faster, NetSuite’s dedicated account receivables feature will automate the entire process of invoice delivery, payment processing, and collection management.

This will save you time by not having you chase clients for payments. It’ll also quicken your payment cycle so that you invest your valuable time finding new clients and expanding your business, and always have enough funds to keep the business afloat.

Besides invoice processing, Oracle NetSuite also automates many mundane accounting tasks too, including:

- Journal entries

- Account reconciliation

- Intercompany transactions

- Variance analysis

With these tedious processes automated, the end of a financial quarter will be less burdensome for you, and you’ll be able to close your books quicker and move on to the next one.

| Starting Price | Top Features | Free Trial | Customer Support |

| $99/month | 1. Invoice management

2. Accurate real-time data 3. Custom role-based dashboard |

No | Email, chat, or call |

Pros

- Multiple custom process workflows

- Several import and export options

- Excellent business intelligence capacities

- KPI integrations enabled on the dashboard

- The HR module allows for streamlining people and financial data

Cons

- Not fit for small businesses

- Customizing reports is difficult

Pricing

Although Oracle NetSuite begins at $99, it’s a custom-priced software, so the final cost will depend on your needs and the number of users you want in your plan.

NetSuite’s price can be broken down as follows:

- An annual license fee for the core platform, number of users, and optional modules

- A one-time implementation fee for the initial setup

Contact NetSuite’s team for a custom quote today.

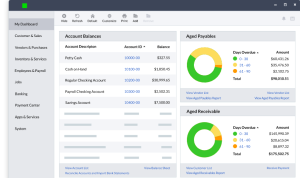

5. QuickBooks — The Best Small Business Accounting Software with Impeccable Time Tracking

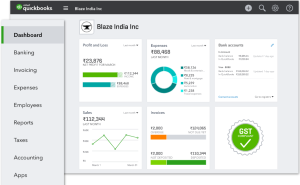

QuickBooks will help you manage your finances easily even if you aren’t an expert in bookkeeping, thanks to its rich database of FAQs, tutorials, and help articles, plus an effortless installation process. It’s not tough to see why it’s one of the best small business accounting software.

Its detailed dashboard will give you a thorough glimpse into your expenses, profit or loss, sales, invoices, and bank balance. In short, you’ll have all the information you need to make informed business decisions.

The best part? All the data is updated in real-time, meaning anytime you make a transaction, the numbers will instantly refresh so that you never have to make any critical business decision based on outdated numbers.

Since you’re working alone, you’ll also need an effective bill management feature to pay your vendors on time and maintain cordial relationships with them — QuickBooks will do that for you.

Once you enter your bills from the vendor, it’ll send you an alert, reminding you to pay them on time.

For recurring payments, you can also set QuickBooks on autopilot and let the transactions go out on your chosen date automatically. This way, you’ll not only save time but also reduce the risk of missing payment dates.

In our testing, we found self-employed individuals appreciate QuickBooks’ helpful and prompt customer support — and every QuickBooks user is entitled to free unlimited support.

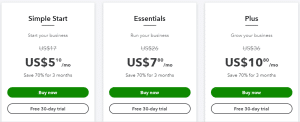

| Starting Price | Top Features | Free Trial | Customer Support |

| $5.10/month | 1. Quick invoices

2. Multiple team members 3. Automated vendor payments |

30 days | Chat or FAQs |

Pros

- Cloud-based operations

- Comprehensive record-keeping and reporting

- A large community of accountants is available

- Numerous report customization options

- Multiple third-party integrations supported

Cons

- No direct customer support

- More prone to manipulation

Pricing

For a mere $17/month, QuickBooks’s Simple Start plan will give you detailed insights and reports of your expenses, a GST and VAT tracker, plus custom invoices.

For more features such as budget management, profitability, employee time and inventory tracking, and more, get a premium QuickBooks plan.

Thanks to a massive sale, you can now get all QuickBooks plans at dirt cheap prices — the Simple Start plan for just $5.10/month and the most premium plan for just $10.80/month.

Try QuickBooks risk-free today with the 30-day free trial and find out if it’s worth your money.

6. Sage Accounting — Popular Self-employed Accounting Software for Auto-categorizing Your Transactions

Sage Accounting is the cream of the crop as far as accounting software for self-employed professionals with an international client base is concerned.

If you’re working for an international client, just enable foreign currency transactions from your Sage Accounting dashboard and select your preferred currency — work with any client across the globe without worrying about how the payment will come through.

Under the same feature, you’ll also get a live currency exchange rate, which will help you see the impact of currency exchange on your income and profit so that you can charge your clients accordingly.

The auto-entry feature not only tracks and auto-categorizes digital transaction data but also helps manage paper receipts. All you’ve to do is snap a picture of the receipt with your phone and upload it on Sage’s dashboard.

It’ll then process all the information on the receipt and save a digital copy of it for future needs — no more hoarding paper receipts in your office. Digitize them and save space.

Also, having all your transaction receipts in one place will help you accurately track your expenses at the end of each quarter.

On top of all of this, Sage Accounting will also let your clients pay you directly from the invoice. Use Sage Accounting’s integration capabilities and install Stripe to allow your customers to pay you with just a click.

This way, you get paid faster and your customers enjoy a seamless payment experience — a win-win for both parties.

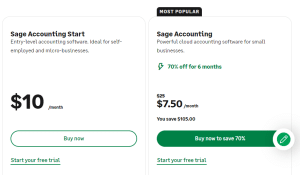

| Starting Price | Top Features | Free Trial | Customer Support |

| $10/month | 1. Intuitive dashboard

2. Integrated payroll management tool 3. Cash management |

30 days | Call |

Pros

- Comes with a free trial

- Easy to share data with an accountant

- Straightforward to drill down transaction details

- An audit trail can be traced effectively

- It can be accessed online with any device

- One of the best accounting software for Canada

- Several user-level security options

Cons

- Limited tools for large businesses

- No time-tracking feature

Pricing

Sage Accounting starts at just $10/month (although it’s offering the first 6 months on its starter plan for 70% off for a limited time). With this plan, you’ll enjoy support for one user, automatic bank reconciliation, a tracker to track what you’re owed, and more.

For advanced reports, multi-currency banking and invoicing, cash flow forecast, and automatic purchase invoice management, consider getting a higher plan.

Try Sage risk-free today, thanks to the 30-day free trial. Test its capabilities to find whether it’ll be a good choice in the long-run, without risking your money.

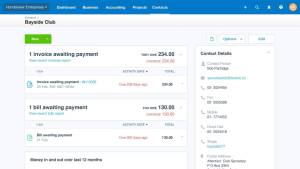

7. Xero — Quality Self-employment Accounting Software for Monitoring Your Investments & their Profitability

Xero is designed to be flexible enough for everyone, whether you’re a freelancer, a self-employed individual, or a bookkeeper.

It’s also trusted by companies all over the world (in fact, it’s also renowned for being one of the best accounting software in the UK), which speaks volumes about its popularity and efficiency.

Save time by automating payment of your bills via Xero’s online bill payment management feature. Along with basic features such as recurring bill payments and storing bill information, Xero creates an informative overview of your bills, complete with your expenses, purchase orders, and a glimpse of which bills are unpaid.

Anytime you want to check how much money you owe to your vendors in that particular month, all it’ll take is a simple click to find out.

Along with your investments with your vendors, you can also check your total investment in a project with Xero’s project tracking feature. It’ll provide you with a detailed dashboard where you can check all your ongoing projects with their estimate and current investment in real-time.

This way, you plan your investment in advance and prevent overspending to the extent that affects your profit. This feature is a blessing for self-employed professionals who don’t have a full-fledged accounting team to maintain the profit margin on every project.

Besides all this, to simplify managing your bank account feed, Xero will also connect to it and automatically import all transaction data at the end of every business day.

You can check and match the numbers — no waiting time for recent numbers to get updated and no drowning in tons of data at the end of the month.

| Starting Price | Top Features | Free Trial | Customer Support |

| $13/month | 1. Automated batch payments

2. Faster expense claims 3. “Pay Now” button on invoices |

30 days | 24×7 online support |

Pros

- Regular feature updates

- Needs no physical installation

- Real-time bank data and reconciliations

- Allows extensive app integrations

- Reports can be customized to your needs

- Allows easy collaboration with accountants

Cons

- No time-tracking feature

- A long learning curve

Pricing

Xero’s most basic plan allows you to send up to 20 invoices and automatically reconcile your bank transactions. Although not as feature-rich as some of the other introductory plans, it’ll suit self-employed individuals and businesses that are just starting out well.

For bulk reconciliation, in-depth analytics, and the ability to track projects, get one of Xero’s many premium plans. Try Xero risk-free today with the 30-day free trial.

8. Bonsai — The Best Self-employed Accounting Software with In-House Human Expert Assistance

Bonsai is the perfect accounting tool for self-employed individuals looking for expert help from professional accountants, plus the assistance of powerful AI-powered accounting software.

We love how every Bonsai user, no matter what plan they’re on, gets a dedicated accountant. Why? Sometimes, just having the right accounting tools isn’t enough. You also need the time and knowledge to make the best out of them.

As a self-employed professional, you already have a lot on your plate and might not have the time to learn using new accounting software. In that case, a dedicated accountant free with your accounting software is the best deal for you. Get all your accounting work done professionally without lifting a finger.

Another thing that we loved about Bonsai is that it offers free consultation on every plan to help you understand your financial needs and goals, pick the right plan and plot the perfect strategy to reach your targets.

The only thing we didn’t like about Bonsai is that there’s a transaction limit on the Starter and Professional plans for up to 35 and 70 transactions, respectively.

While it might not be an issue in the beginning, it might hinder your business expansion plan — but not if you’re willing to switch to Bonsai’s Elite plan later.

But nothing to take away from Bonsai. It offers detailed reporting — you’ll get custom reports on your supplier investment and revenue from clients. At any given point, you can check your business’s cash flow to make the right financial decisions.

| Starting Price | Top Features | Free Trial | Customer Support |

| $24/month | 1. Banking details on dashboard

2. Extensive reports 3. Mileage tracking template |

14 days | Support center with FAQs |

Pros

- Easy to use and get started

- An intuitive dashboard

- A lot of automated features

- Offers comprehensive document management

- Comes with a 14-day money-back guarantee

- A summary-oriented dashboard

Cons

- Needs more automation options

- Limited integration options

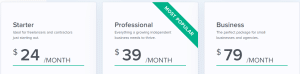

Pricing

Bonsai, although one of the more expensive options on our list, tags along with a ton of features on all its plans plus a real human expert that makes its price reasonable enough.

At just $24/month, you’ll have expense tracking, support for unlimited clients and projects, and permission to admit up to 5 project collaborators.

For accountant access, subtractor onboarding plus management, Calendly and Zapier integration, and more, get one of many premium Bonsai plans.

Try Bonsai risk-free with a 14-day free trial and a 14-day money-back guarantee. Don’t like it? Get a full refund.

The Best Self-Employed Accounting Software Companies | Compared

For an easy comparison, our table here highlights only the key differences between the top self-employed accounting software to help you zero in on the best software for your needs within a matter of minutes:

| Accounting Software | Starting Price | Top Features | Free Trial | Customer Support |

| Zoho Books | $0 |

|

Yes | 24×5 – email or call |

| FreshBooks | $6/month |

|

30-day free trial | Call |

| Patriot | $20/month |

|

30 days | Call, chat and e-mail |

| Oracle NetSuite | Custom pricing |

|

No | Email, chat or call |

| QuickBooks | $5.10/month |

|

30-day free trial | Chat or FAQs |

| Sage | £0 |

|

30-day free trial | Call |

| Xero | $13/month |

|

30-day free trial | 24×7 online support |

| Bonsai | $24/month |

|

30-day free trial | Support center with FAQs |

Why Do I Need Accounting Software if I’m Self-Employed?

When you’re self-employed, it becomes crucial to have tools that automate several business functions. Here are key reasons you need accounting software, even if you are self-employed:

Better Finance Management

Using accounting software can simplify finance management like never before. For example, instead of manually logging hundreds of transactions into your excel, you can have them automatically tracked by the accounting tool.

This way, you can access your expenses and calculate your total investment anytime without lifting a finger. In short, these accounting platforms make every other accounting process, be it invoice management or account reconciliation, easier.

Timely Bill Payments

As a self-employed professional running the whole ship alone, it’s natural for small things such as vendor bills to slip your mind. Unfortunately, that’s not an excuse that’ll work with your suppliers and might permanently ruin your relationship.

To prevent that from happening, get accounting software to handle your bills. Set automated payments for recurring expenses or set bill reminders so that you never miss a deadline.

Easier Taxing

No one likes taxes, especially if you’re a self-employed professional with many other things on your plate. But with an accounting tool that keeps all your expenses and profits in one place and gives you a quick glimpse into all your assets, taxing becomes a breeze.

Some tools, like Netsuite and Bonsai, also offer an exclusive taxing service that further simplifies getting prepared for tax season.

Faster Processing

When you are self-employed, you cannot afford to waste time on unnecessary manual processes. That’s why you need accounting software — to speed up every process with automation.

For example, instead of wasting time sending out your payments manually, you can set up bulk payments in advance and program them to go out automatically on a specified date.

How We Chose the Best Self-Employed Accounting Software for 2024

Here’s how we refined our list of the best self-employed accounting software for 2024:

Easy to Use

Self-employed professionals don’t have a lot of resources or a tech team at their disposal; they need to do everything independently. That’s why you need software that’s easy to use and doesn’t need much time to master.

We’ve included solutions renowned for being superb for self-employed individuals needing user-friendly accounting software — plus, if you’re unsure, all of our recommendations offer lengthy free trials or an entirely free plan so you can test the platform before committing.

Automation Features

No self-employed individual can function without automated accounting software. After all, who has the time to log hundreds of transactions manually, reconcile them with the bank, or create invoices and process countless payments?

You already have too much on your plate to take upon the responsibility of these manual tasks. That’s why you need accounting software that can automate most of these repetitive tasks.

All the tools we’ve reviewed here have powerful automation capabilities that’ll help you save time and let you focus on more pressing business concerns.

Pricing

Although most of these tools are designed for small businesses or established companies, you’ll still find plenty of affordable options — and some that have been specifically designed for freelancers and the like.

For example, despite being one of the best accounting tools, Zoho Books has a forever-free plan. Similarly, popular and highly-awarded Sage accounting services are available at just $10/month, and Bonsai is one of the most popular tools for freelancers.

We’ve included a variety of accounting solutions to ensure that regardless of your needs and budget, there was a tool that would meet them.

Customer Support

When you’ve all the responsibilities on your shoulder, the last thing you want is malfunctioning accounting software that could disrupt business for the whole day.

That’s why we always recommend accounting platforms that come with reliable customer support teams. Whether through emails, chat, or phone, you should have a way to get in touch with the team in case of a crisis.

Self-Employed Software FAQs

How does accounting software work?

What’s the best self-employed accounting software?

What’s the easiest accounting software for self-employed individuals?

Can you use QuickBooks self-employed for free?

What’s the best free accounting software for self-employed individuals?

What’s the best cheap self-employment accounting program?

Conclusion | What’s the Best Self-Employment Accounting Software in 2024?

Our list includes the best self-employment accounting software for all your needs. Whether you need to automate payment reminders and custom invoices or need an end-to-end accounting solution, we’ve got you covered.

Zoho Books, despite the tough competition, emerged as the best self-employment accounting software in our research on the back of phenomenal features like automating recurring invoices and reminders, banking and CRM integrations, employee time tracking, and quick payments.

Plus, it’s easily the best free self-employment accounting software, with a free forever plan. Try Zoho Books risk-free now, with either the free plan or the 30-day free trial to discover what this tool can do for you.