How Does Payroll Work? An In-Depth Guide for 2024

How does payroll work? Knowing this is essential for businesses of all sizes. Payroll is the process of calculating and issuing employee wages, including any associated deductions such as taxes and benefits. It’s integral to running a successful business, but it can be complicated to manage.

According to studies, 49% of American employees will leave if they experience two or more payroll issues.

This makes it important for employers to understand how payroll works and ensure that their employees are paid accurately and on time. Fortunately, there are several payroll software options available that’ll take the stress out of managing your business’ finances.

We’ve comprehensively reviewed and compared 7 of the best payroll software packages, including Zoho Books, Oracle NetSuite, and QuickBooks. Read on to learn how these solutions can help you pay your employees on time and hassle-free.

How Does Payroll Work?

In simple terms, payroll focuses on calculating and distributing compensation to employees in exchange for their work. It includes all wages, salaries, bonuses, commission payments, taxes, and deductions that are associated with an employee’s job.

The payroll process begins when an employer hires a new employee and completes the necessary paperwork, such as hiring forms and tax documents.

The employer must then calculate how much money to give each employee in terms of salary or hourly wages for the amount of time worked during a given period (usually weekly or bi-weekly).

This calculation will also include any applicable:

- Overtime pay

- Bonuses, or

- Commissions

Once wages have been calculated, the employer makes deductions for taxes, insurance, and other benefits. After taking these into account, the employer provides the employee with his or her net pay (the amount of money they get to take home).

Employers must then make sure that all payroll information is accurately recorded and reported to government agencies such as the Internal Revenue Service (IRS) and state/local tax authorities.

This includes reporting any amounts withheld from employees’ checks for taxes and providing a summary of income earned each year on Form W-2. Additionally, employers must pay certain taxes on behalf of their employees, such as Social Security and Medicare.

Finally, payroll is responsible for ensuring that employees are paid promptly each pay period.

Employers must have a system in place to ensure that all payments are made accurately and on time, as this not only helps businesses avoid fines or penalties but also keeps morale high among staff members.

What is Payroll?

Payroll encompasses more than just bi-weekly paychecks. It’s an important process that involves the calculation, withholding, and distribution of employee wages.

Payroll services ensure that all employees are paid accurately and on time and that payments comply with relevant tax laws.

It’s also important to note that payroll is much more than just calculating wages and issuing checks. It also involves keeping track of:

- Employee benefits

- Deductions

- Vacation pay

- Sick days

And other important information.

Why Do I Need Payroll Software for My Business?

Payroll software helps businesses of all sizes manage the payroll process efficiently and accurately while saving time and money. The importance of payroll software shouldn’t be underestimated.

Here are some of the key benefits of having payroll software for your business:

- No more late payments — Payroll software helps you keep track of your employees’ pay schedules, ensuring that all payments are made on time.

- Tax compliance — Payroll software helps you comply with all applicable tax regulations and ensures that the correct amount of taxes are being withheld from each employee’s paycheck.

- Accurate records — Payroll software allows you to store accurate financial records, which can be used for reporting purposes and decision-making.

- Easier payroll management — By automating many aspects of the payroll process, payroll software simplifies payroll management and reduces administrative tasks such as calculating wages and deductions and submitting tax forms.

- Cost savings — Payroll software can save you money by reducing the need to hire financial experts or payroll staff. It also helps reduce errors which can lead to costly fines or penalties.

Payroll software is one of the must-have digital tools if you want to run your business smoothly.

It’s an invaluable tool for businesses of all sizes, and it should be a part of your operations if you want to ensure accuracy, compliance, and efficiency when managing payroll.

The Best Payroll Software Solutions for 2024 | Top 7 Shortlist

Hundreds of payroll software solutions exist, but only a few offer the features and functionality you need to manage payroll efficiently. Our research found that Zoho Books is the best payroll software for small businesses in 2024, but to give you more options, we’ve shortlisted the top 7 solutions:

- Zoho Payroll— Our Top Pick for the Best Payroll Software Any-Sized Business | Try it for 14 days and See for Yourself.

- Oracle NetSuite — Perfect for Companies With Multiple Locations and Varied Employee Needs.

- QuickBooks — Small Businesses’ Most Popular Payroll Software Choice | Optimize Your Payroll and Try it Risk-Free for 30 Days!

- Sage — Tailored Payroll Solution That Caters to All Unique Business Requirements.

- FreshBooks — A Comprehensive Accounting Solution to Simplify Payroll Processing With Automation.

- Xero — An Efficient Cloud Solution Designed to Help Manage Taxes, Employees, Benefits, and More.

- Bonsai — An Excellent Platform for Freelancers and Startups Who Need to Manage Their Payroll Quickly.

The Best Payroll Providers | Reviewed

Let’s take a closer look at how each of these payroll solutions can benefit your business.

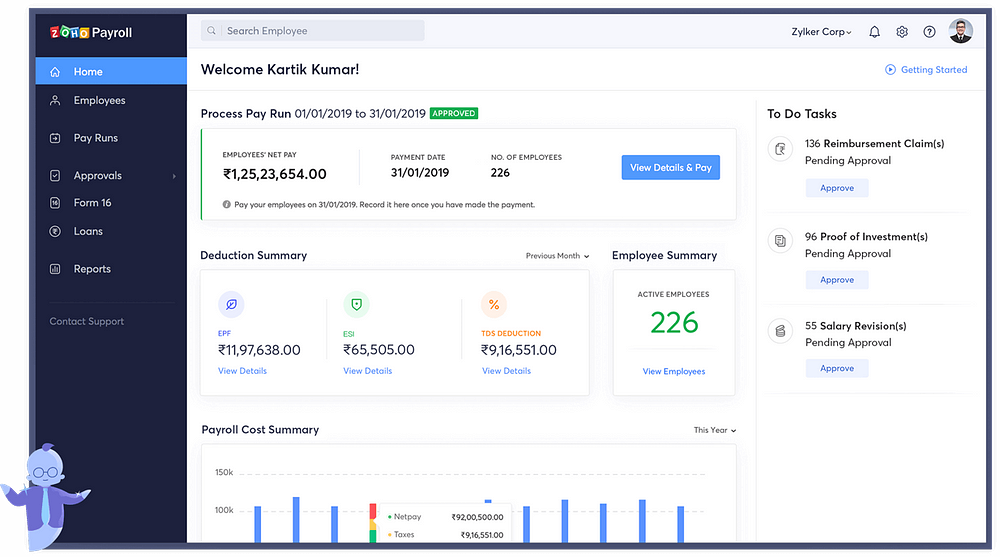

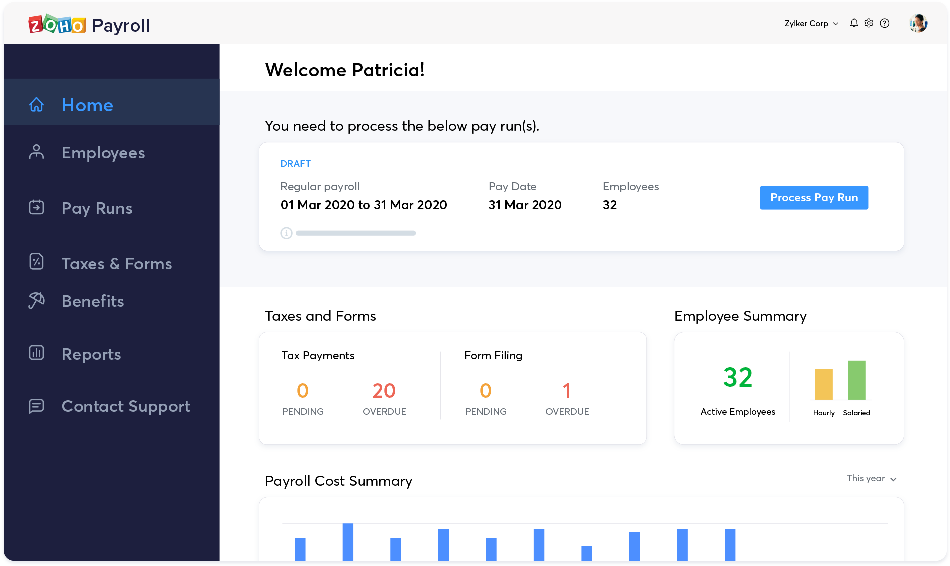

1. Zoho Payroll — Top Overall Pick for the Best Payroll Provider

Zoho Payroll is an excellent payroll provider that offers an easy-to-use interface and comprehensive features to make managing employee wages, taxes, and other financial requirements a breeze.

Its robust set of automations and accuracy in payroll processing make it our top overall pick for the best payroll provider out there.

| Pricing | Best Features | Mobile App | Trial Version |

| $21/month | 1. Statutory Components 2. Salary Templates 3. Direct Deposit |

Yes | Yes |

Zoho Payroll allows businesses to easily set up statutory components such as employee insurance, gratuity, and provident fund deductions. This makes it easier for businesses to keep track of the various elements associated with payroll processing in one place.

By setting up these components beforehand, businesses can save time and money by avoiding having to manually enter them each month when paying employees.

Zoho’s salary templates allow businesses to create and save salary structures for different employee roles. Businesses can easily keep track of the various components associated with each role, such as deductions and allowances.

Lastly, Zoho Payroll makes payroll processing much easier by enabling automated direct deposit of salaries. This saves businesses the time and effort it takes to deliver paychecks or transfer funds into employee accounts manually.

Pros

- Budget-friendly

- 100% automated direct deposits

- Templates let you set & forget

- Fantastic automation capabilities

Cons

- UI can be slow at times

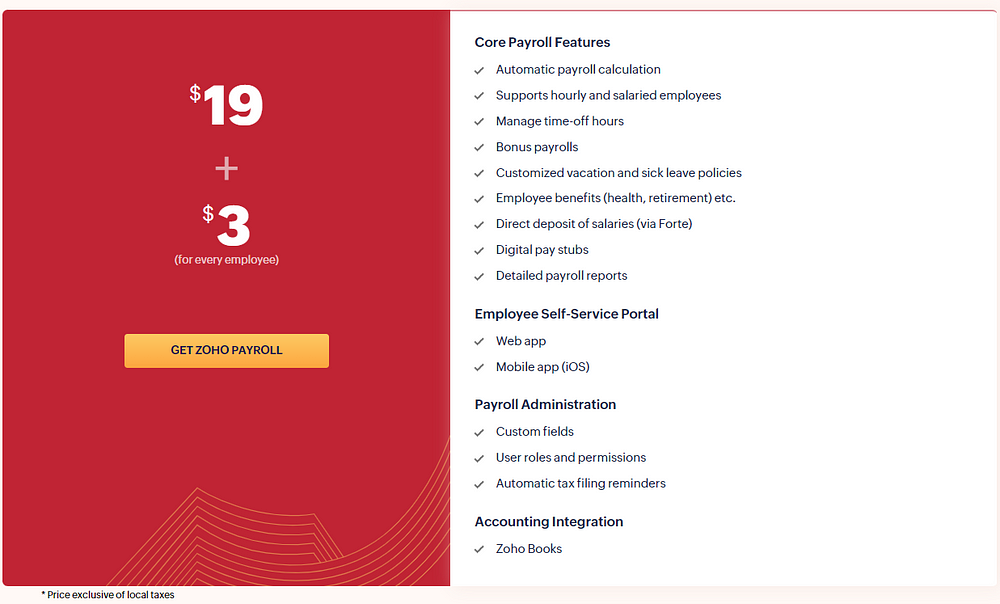

Pricing

Another great thing about Zoho is that they only offer a single plan for payroll software, and with it, you get everything you need to manage your entire payroll process in one simple package.

This includes:

- Tax filing

- Employee salary and benefits tracking

- An employee self-service portal, and

- Automated payouts

With Zoho Payroll, you can be sure that your payroll process is running smoothly and accurately with minimal effort on your part. On the whole, Zoho is a phenomenal payroll provider that offers excellent automation and accuracy in payroll processing.

It has all the features you need to manage employee wages, taxes, and other financial requirements with ease. The UI can be slow at times, but since this is a cloud-based program, it largely comes down to your internet speed.

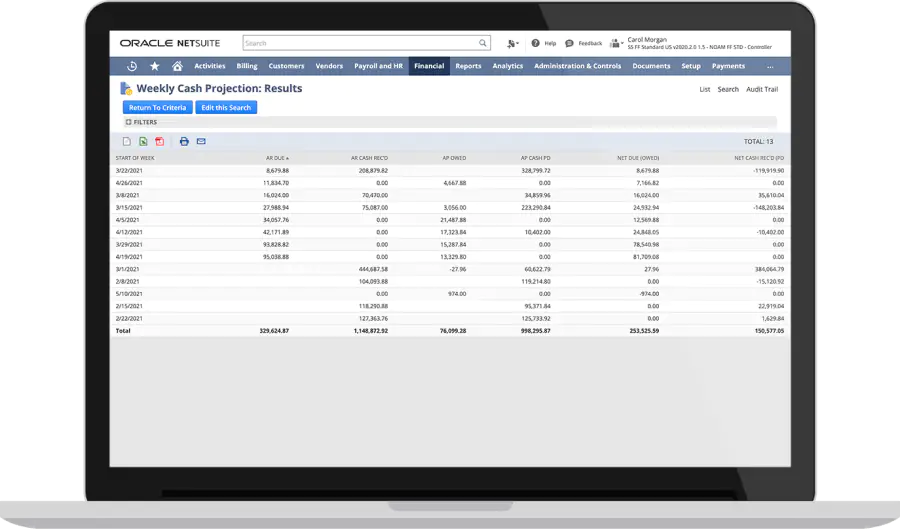

2. Oracle NetSuite — Complete Payroll Solution For Large Enterprises

Oracle NetSuite’s Payroll Management System is one of the best payroll solutions for large businesses. It provides a comprehensive, integrated approach to managing all aspects of payroll, from tax and compliance management to employee satisfaction surveys.

| Pricing | Best Features | Mobile App | Trial Version |

| Not Published | 1. Automated Filing and Deposits 2. Flexible Payment Schedules 3. Employee Self Service |

Yes | Yes |

From ACA forms, 1099s, and W2s to direct deposits, Oracle NetSuite’s automated filing and deposit capabilities make it easy to stay compliant with all local, state, and federal regulations.

With automated filing and deposits, you can reduce the risk of manual errors and avoid incurring penalties. NetSuite also streamlines the process of making payments for employees, contractors, and vendors, so you won’t have to worry about lost checks or mishaps with bank accounts.

Its flexible payment schedule feature allows businesses to customize payroll schedules and frequencies based on their needs.

This comes in handy for businesses with fluctuating staff or budgets: you can easily adjust pay periods without having to enter each employee’s information into the system manually.

Lastly, this software enables employees to access their payroll information easily. This includes:

- The ability to view their current and past pay statements

- Submit expense reports, and

- Even make changes to their personal information, such as addresses or tax withholdings

By giving employees direct access to their data, NetSuite eliminates the need for complicated forms and manual processes, resulting in a more streamlined payroll process.

Pros

- Complete ERP system

- Perfect for large companies

- Cloud-based

Cons

- Not for small businesses

Pricing

Oracle NetSuite offers a variety of pricing options to meet the needs of businesses of all sizes.

The cost depends on the number of features and modules you need as well as your company’s size. Unfortunately, you can’t buy its payroll system as a stand-alone product, so it might not be the best option for small businesses.

Still, Oracle NetSuite’s Payroll Management System is an excellent choice for larger businesses looking for a comprehensive, integrated payroll solution.

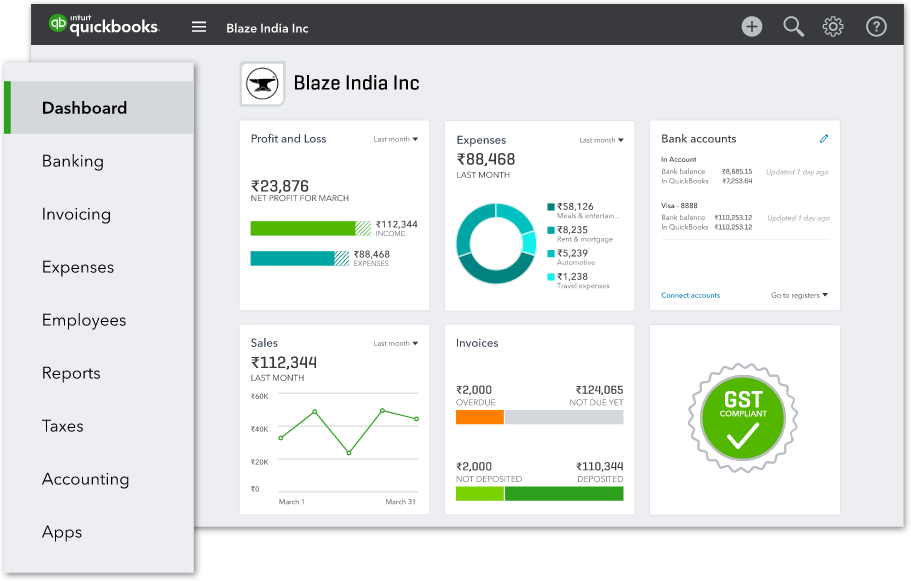

3. QuickBooks — Small Businesses’ Favorite Payroll Software

QuickBooks Payroll is the perfect payroll solution for small businesses that are looking for an easy and reliable way to manage their employees’ salaries. It’s an affordable, user-friendly accounting and payroll software program that offers a range of features.

| Pricing | Best Features | Mobile App | Trial Version |

| $37.50/month | 1. Tax Penalty Protection 2. Same-Day Direct Deposit 3. Automatic Tax Calculations |

Yes | Yes |

One of QuickBooks’ standout features is its tax penalty protection. This feature allows you to rest assured that your payroll taxes are filed accurately, and on time, so you don’t get hit with unnecessary penalties or fees.

QuickBooks Payroll also offers an efficient direct deposit option for employees. It’s a great way to ensure that your employees get paid quickly and accurately without having to deal with the hassle of manual payroll processing. Plus, with same-day direct deposit, you can be sure that your employees will always receive their salaries on time.

Pros

- Value for money

- Tax calculator

- QuickBooks integrations

- One of the best desktop accounting tools

Cons

- It can be expensive if you’re running a remote team

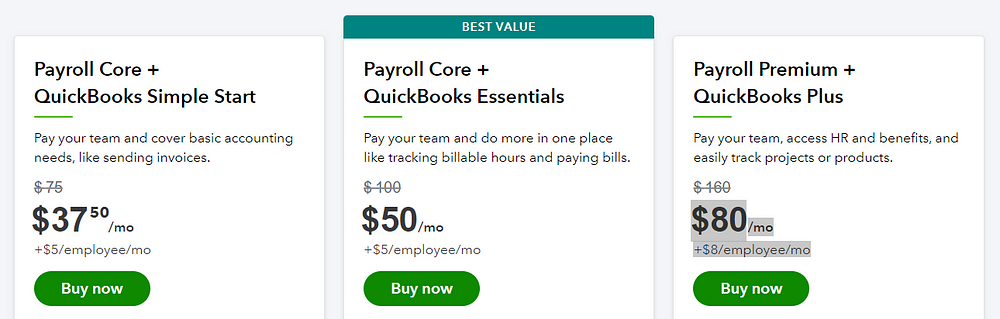

Pricing

The most affordable plan is Payroll Core+QuickBooks Simple Start. This plan includes the essentials for managing payroll, such as tax and payment calculations, reporting and filing of returns, direct deposits, and more.

The Payroll Core+QuickBooks Essentials plan provides more features, including tracking expenses and invoicing capabilities with integration with QuickBooks Online.

The most comprehensive plan, Payroll Premium + QuickBooks Plus, includes all the features from the previous plans plus more advanced tools such as time tracking, vacation accrual, and sick leave management.

From tax penalty protection to same-day direct deposit and automatic tax calculations, QuickBooks has everything you need to keep your payroll running smoothly.

However, it can be expensive if you’re running a remote team, as you’ll only be able to add remote employees on the higher-tier plans.

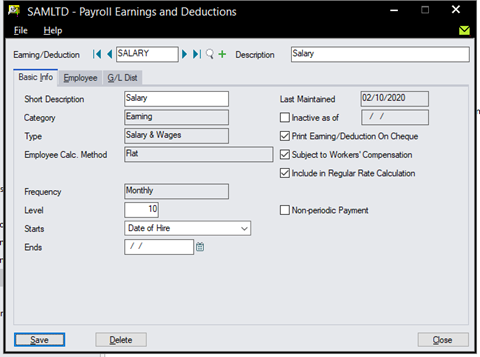

4. Sage — Excellent Software for Teams Located in the US and UK

Sage Accounting’s payroll software is an excellent choice for teams on both sides of the Atlantic. In fact, it’s one of our picks for best payroll software in the UK.

| Pricing | Best Features | Mobile App | Trial Version |

| $10/month | 1. Leave Request Manager 2. Create W2s 3. Payroll Expense Tracking |

Yes | Yes |

Employee absences can put a strain on your resources. Sage Accounting makes managing leave requests easy by helping you seamlessly track and approve them.

Sage also optimizes your sales processes, whether you’re overseeing a small number of transactions or a high volume of sales. The software can help you:

- Manage and keep track of your customer information

- Streamline your quote-to-cash process, and

- Automate order processing

If you need to track payroll expenses, Sage Accounting has you covered. The software allows you to easily monitor and manage payroll expenses in real-time. This is important for businesses that need to stay on top of their budgeting and ensure they’re not overspending.

On top of all this, with the detailed reports provided, it’s easy to keep tabs on your spending and make sure everything is running smoothly.

Pros

- Affordable

- Multi-currency

- One of the best cloud-based accounting tools

Cons

- Outdated UI

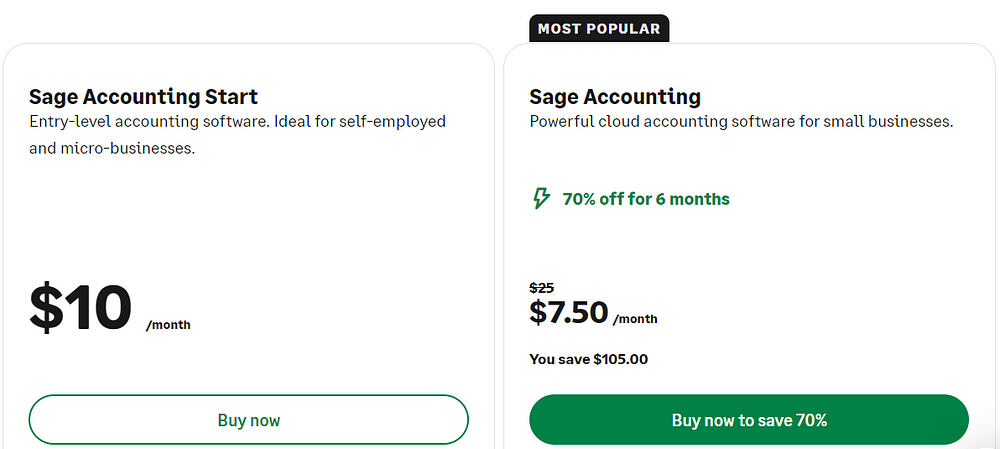

Pricing

If you want to try Sage’s payroll system, you need to purchase the whole bundle at one of two pricing plans:

- Sage Account Start — Includes essential accounting features such as invoicing, bank reconciliation, and more. Plus, you get access to Sage’s powerful payroll system, so you can easily manage employee payments and taxes.

- Sage Accounting — Comes with all of the same features as Account Start plus extra bonuses like budgeting analysis, inventory tracking, and project management capabilities—plus a whole lot more.

Sage Accounting offers a great range of features, such as a leave request manager, W2s generator, and expense tracking, that make it easy to stay compliant. The only downside is its outdated UI, which can be slightly difficult to navigate the first time around.

5. FreshBooks — Automate Your Payroll With Ease

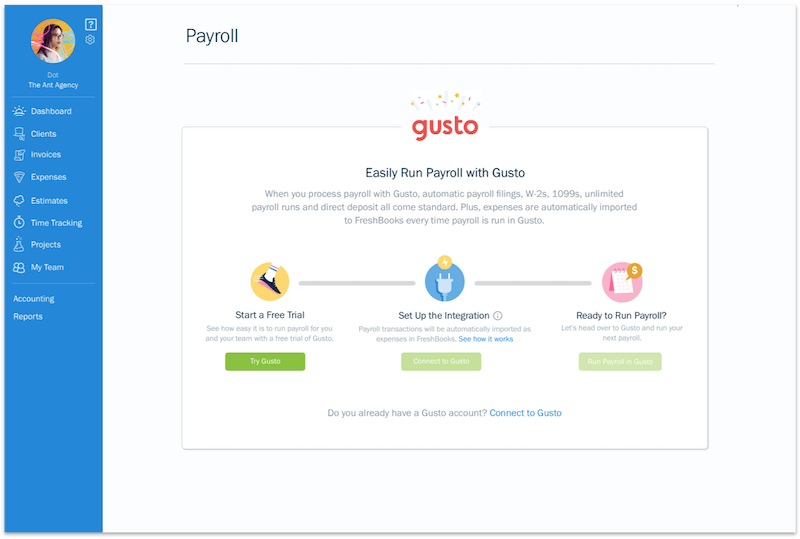

FreshBooks is one of the best accounting software programs, and it boasts its own integrated payroll solution called Gusto. This highly efficient solution can help you manage your finances, automate your payroll process, and save time.

| Pricing | Best Features | Mobile App | Trial Version |

| $40/month | 1. Built-in Time Tracker 2. Integrated Tax Calculations 3. Easy Payroll Setup |

Yes | Yes |

With its reliable time-tracking tools, FreshBooks makes it easy to log employee hours and generate accurate payroll reports without requiring any manual intervention.

With this feature, you can easily calculate taxes on employee salaries and ensure those taxes are paid on time, saving you from the potentially costly consequences of late payments.

Lastly, FreshBooks makes setting up payroll a breeze. You can get the components ready in just a few clicks and start processing payments in no time.

This is a massive time-saver and is particularly useful for HR teams that manage multiple payrolls simultaneously.

Pros

- Smooth payroll management

- Offers time tracking

- Automated tax and timekeeping

Cons

- Can be pricey

Pricing

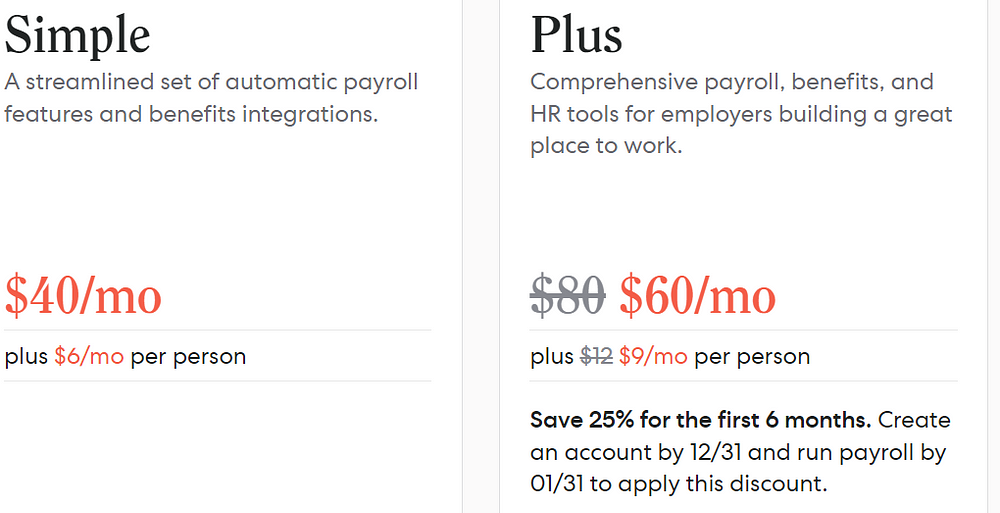

Since Gusto is a different entity from FreshBooks, the pricing structure is different. With Gusto, you get simple and convenient payroll management with two flexible plans to choose from — Simple and Plus.

The Simple plan allows for full-service single-state payroll, whereas the Plus plan allows for multi-state payroll, including W-2s and 1099s. With either plan, you’ll enjoy:

- Access to secure online payroll services

- Automatic tax filing and payments

- Custom HR support

- Employee onboarding tools

And more. FreshBooks is undoubtedly one of the best payroll providers out there. It has a great set of features that make automating payroll processes easy and efficient.

With its built-in time tracker, integrated tax calculations, and easy payroll setup, it is one of the most user-friendly solutions available. The only downside to FreshBooks’ Gusto payroll solutions is that they can be slightly pricey compared to other providers.

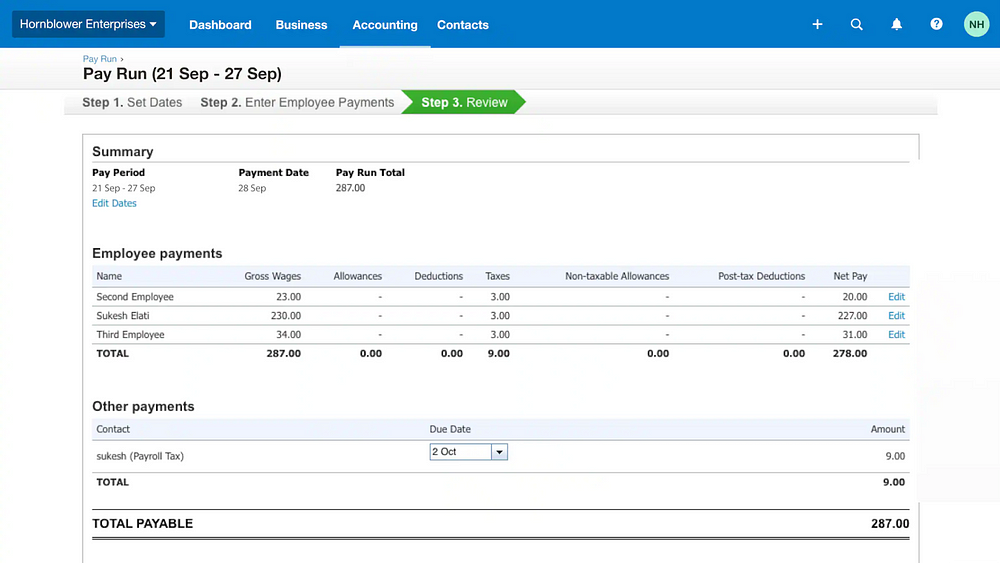

6. Xero — Simple Yet Effective Payroll Solution for Small Businesses

Xero is basically accounting software at its core, but it also offers an excellent payroll feature. It’s a powerful and simple solution for small businesses that want to manage their payroll efficiently.

| Pricing | Best Features | Mobile App | Trial Version |

| $13/month | 1. Simple Online Pay Runs 2. Pay Into Bank Accounts 3. Easily Integrate With A Payroll App |

Yes | Yes |

Use Xero payroll to quickly and easily set up and run your company’s pay runs with just a few clicks. The intuitive interface makes it simple to track employee hours, calculate payroll taxes and deductions, and generate payslips for each worker.

Having a database in which you can store employees’ banking details and quickly pay them via direct deposit is a fantastic benefit of Xero payroll. It saves you time on manual processing and reduces the potential for human error.

Xero understands that some complex payrolls require specific apps, which is why their software integrates with a range of other payroll solutions. This allows you to make the most out of your payroll processes and automate tedious tasks such as calculating taxes, deductions, and payouts.

Rather than being limited to the features Xero offers, you can add new tools and features by linking up with new apps as your business grows and changes.

Pros

- Easy to use

- Unlimited user

- Automatic payment

Cons

- Very basic features

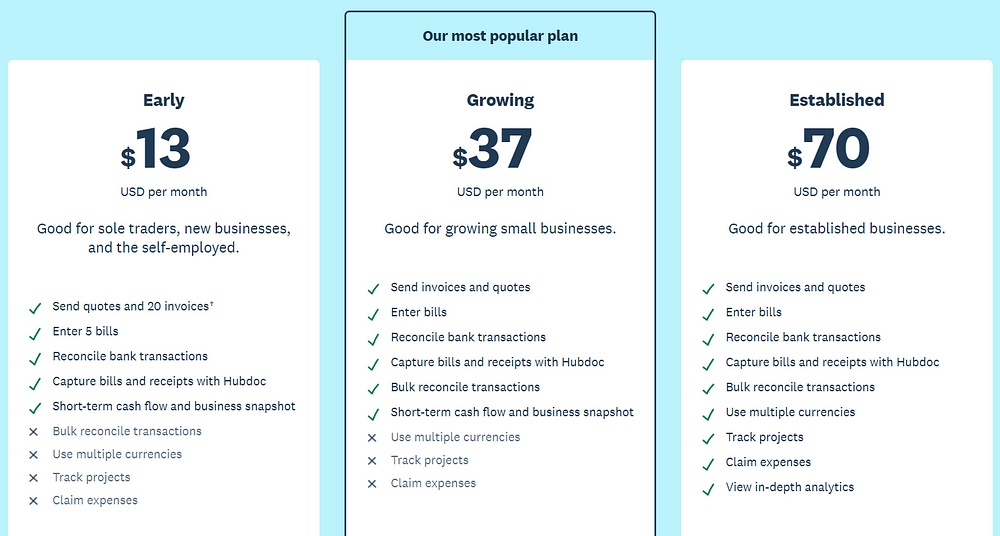

Pricing

What’s best about Xero is that it allows you to have unlimited users. There are three plans to choose from, and it’s very affordable for small businesses:

All in all, Xero payroll is an excellent solution for small businesses with its simple yet effective features. With the ability to pay into multiple bank accounts, it makes managing your payroll process much easier.

Unfortunately, it doesn’t offer as many features as some of its competitors, but this should not be a major issue since you can easily integrate with other apps. For an in-depth guide, check out our comprehensive review of Xero.

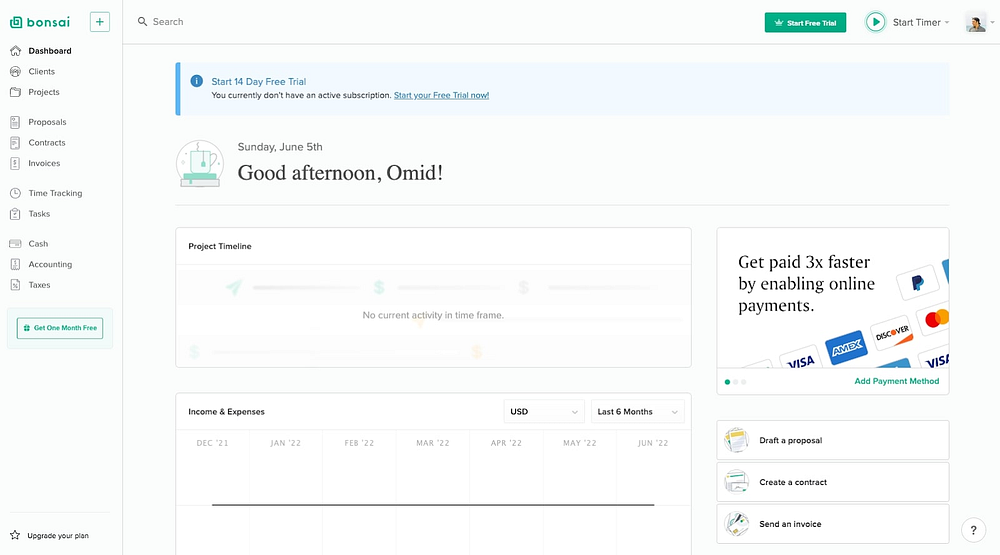

7. Bonsai — Best Freelancers’ Payroll and Accounting Solution

Bonsai is highly regarded by freelancers and small business owners as one of the best payroll providers. It offers a comprehensive set of features to help manage payroll, taxes, accounting, and more.

| Pricing | Best Features | Mobile App | Trial Version |

| $24/month | 1. Integrated Tax Calculations 2. Tax Compliance 3. Multi-Currency Support |

Yes | Yes |

Running a payroll isn’t just for businesses; it also applies to freelancers and the self-employed.

But for many, staying compliant with tax rules and regulations can be a daunting task. Bonsai’s automated expenses feature can easily track payments and ensure that you’re compliant with tax laws.

By automating your expenses, you can save time and energy on tedious paperwork while making sure everything is fully squared away. Finally, with Bonsai’s multi-currency support, you can easily receive payments in different currencies.

This makes it easier for freelancers and small business owners to work with clients from around the globe without having to worry about currency conversion fees or risks.

Pros

- Tax computations

- Robust integrations

- Expense tracking

Cons

- Limited payroll features

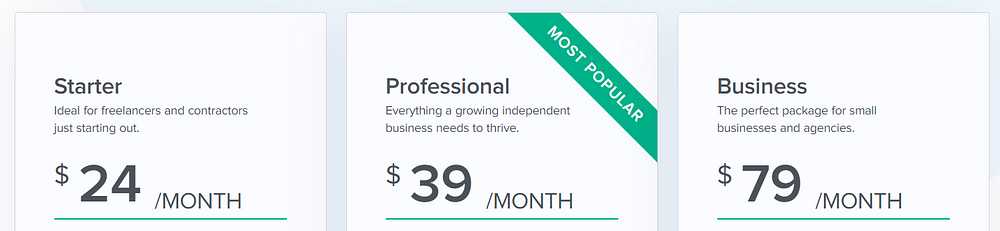

Pricing

Bonsai offers three pricing plans. The main difference between the plans is the number of users and the features included. What’s nice is that all plans come with basic payroll features such as payroll runs, automated tax computation, and API integrations.

Like Xero, Bonsai has minimal payroll features — but it does the job of managing taxes and expenses very well.

Overall, Bonsai ranks among the best accounting software for small business owners and freelancers who need to ensure their finances are taken care of properly.

Best Payroll Solutions | Top 7 Compared

Check out our head-to-head comparison table of the best payroll providers on the market.

Whether you’re a business looking to streamline your payroll processes or an employee who needs to stay abreast of the latest developments, choosing a provider that meets all your needs is important:

| Software | Pricing | Best Features | Mobile App | Trial Version |

| Zoho Payroll | $21/month | 1. Statutory Components 2. Salary Templates 3. Direct Deposit |

Yes | Yes |

| Oracle Netsuite | Not Published | 1. Automated Filing and Deposits 2. Flexible Payment Schedules 3. Employee Self Service |

Yes | Yes |

| Quickbooks | $37.50/month | 1. Tax Penalty Protection 2. Same-Day Direct Deposit 3. Automatic Tax Calculations |

Yes | Yes |

| Sage Accounting | $10/month | 1. Leave Request Manager 2. Create W2s 3. Payroll Expense Tracking |

Yes | Yes |

| FreshBooks | $40/month | 1. Built-in Time Tracker 2. Integrated Tax Calculations 3. Easy Payroll Setup |

Yes | Yes |

| Xero | $13/month | 1. Simple Online Pay Runs 2. Pay Into Bank Accounts3. Easily Integrate With A Payroll App |

Yes | Yes |

| Bonsai | $24/month | 1. Integrated Tax Calculations 2. Tax Compliance 3. Multi-Currency Support |

Yes | Yes |

Conclusion | What’s the Best Payroll Software in 2024?

Running a payroll shouldn’t be difficult or time-consuming, and with the right payroll provider, it doesn’t have to be. This comprehensive list of the best payroll software can help you find a solution that works for your business.

From cloud-based accounting solutions to full-service HR suites, these providers offer features designed to make payroll processing easier and more efficient.

Zoho Payroll is our top overall pick for the best payroll software. It offers an intuitive user interface, cloud-based accounting services, and integrated HR features all in one package.

Additionally, Zoho Payroll is highly affordable, making it an excellent choice for small businesses with limited budgets. It offers both free and paid plans so you can find the best fit for your budget.